- Two-month extension granted to 6.5%.

- Insured deposit; Formal approval is still awaited.

- A longer extension is sought after talks with the IMF.

ISLAMABAD: The United Arab Emirates has agreed to a short-term extension of a $2 billion deposit for Pakistan for a period of two months. The news reported on Friday, as Islamabad prepares for talks with the International Monetary Fund (IMF).

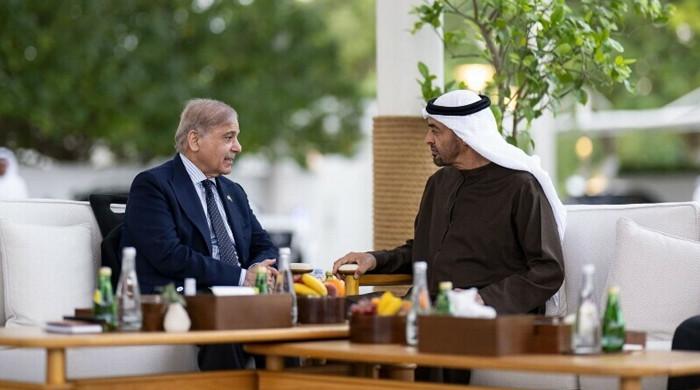

This assurance was given to Pakistan when Deputy Prime Minister and Foreign Minister Ishaq Dar contacted the UAE top brass this week. A senior official confirmed that the UAE agreed to the short-term extension until April 17, 2026.

The development comes ahead of Pakistan’s upcoming review talks with the IMF for the third review and release of the fourth tranche of $1 billion under the $7 billion Extended Fund Facility (EFS).

“The UAE has granted short-term renewal at a rate of 6.5%,” senior official sources said, adding that formal approval for the quarter in question was awaited and expected to be received any day now.

Responding to a question, the Foreign Ministry spokesperson said he was not aware of the context and content of the statements made in the Standing Committee on Finance by Finance Ministry officials.

He could only confirm that the Deputy Prime Minister had addressed the matter and was playing a very positive role in coordinating and consulting with the relevant authorities in the UAE.

“The permanence of the rollover is the prerogative of the depositor. Through the positive role of Dar, we can say that the rollover is assured and the tenure is not tied. Since the rollover continues, this matter remains under control,” the spokesperson said.

He also referred to the Finance Minister’s statements that there was no external financial gap in terms of Pakistan’s profile, including with reference to the country’s commitment to the IMF.

Previously, the UAE had renewed more than $2 billion in just one month, of which $1 billion was due on February 16 and the remaining $1 billion on February 22.

The government had asked the UAE to renew the depot for two years and subsequently submitted a fresh application to extend the facility. The UAE has been told that after the IMF review talks, Islamabad will again approach the authorities to request a renewal of longer-term deposits.

In January, the United Arab Emirates had rolled over more than $2 billion for a month after the amount expired. A third tranche of $1 billion will mature in July 2026.

During December, the Ministry of Finance prepared working papers and drafted a letter to the UAE government requesting the transfer of the entire $3 billion over one year. The government had hoped the extension would be secured in advance, as in previous cases, but the UAE initially agreed to an extension of just one month.

Last week, Finance Ministry officials failed to give a clear assurance to a parliamentary committee about the transfer of the entire $3 billion deposit, placing responsibility on the Foreign Ministry.

The Finance Minister told the committee that Pakistan had provided the IMF with a clear external financing plan and that talks were continuing with the UAE authorities. He said bilateral agreements were in place and any changes in the situation would be communicated.

According to officials, the Abu Dhabi Fund for Development has placed $3 billion in the State Bank of Pakistan in three separate tranches. Two tranches of $1 billion each expired on January 17 and 23 and were renewed for one month, while the third tranche of $1 billion expires in July and will be taken up for renewal closer to its expiration.

In December, Saudi Arabia agreed to extend the maturity of its $3 billion deposit in the State Bank of Pakistan by another year. Under a 2021 deal, Riyadh had placed $3 billion in Pakistan’s central bank.

For the current fiscal year, Pakistan is seeking the transfer of about $12 billion in foreign deposits, including about $9 billion from Saudi Arabia and China ($5 billion from Saudi Arabia and $4 billion from China), in addition to $3 billion placed by the United Arab Emirates.