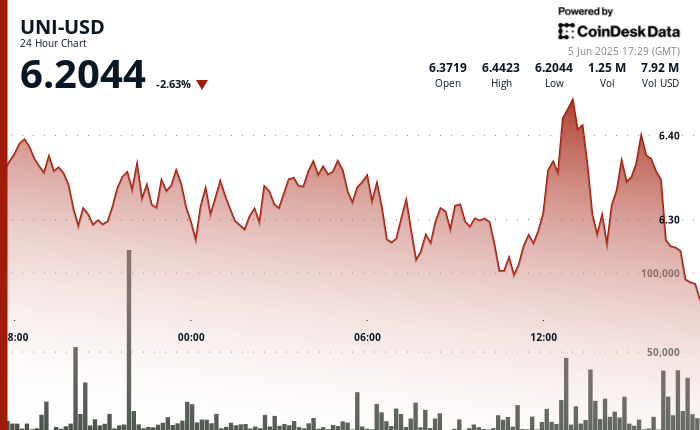

Uniswap’s Token Uni has been under renewed pressure as the early earnings unraveled, sending prices below the critical support zone of $ 6.22.

The day began with an acute rally that led Uni to a maximum intradic of $ 6.44, but the strong sale arose shortly after, erasing the progress.

The change in the structure of the market is produced in the midst of a broader uncertainty linked to macroeconomic events, including monetary policy signs and ongoing commercial tensions.

While Uni had shown signs of resilience earlier for the week, today’s reversion indicates a growing risk aversion among merchants.

Analysts now see $ 6.20 as the final defense line before the potential.

TECHNICAL ANALYSIS

- Uni quoted in a volatile $ 0.22 range between $ 6.22 and $ 6.44.

- A 3.1% rally reached its maximum point at $ 6.44 before the trend was invested.

- Heavy sale at 13:45 caused the price to collapse at $ 6.31 in 244,581 volume.

- Multiple recovery attempts failed, forming lower maximums to $ 6.31, $ 6.30 and $ 6.29.

- The last hour saw Uni fall to $ 6.20, with a bassist volume accelerating at the closure.

- $ 6.22– Support area of $ 6.25 remains key, but now under direct threat.

- The general impulse has become negative with bearish confirmation at $ 6.35.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.