The cryptocurrency market faces increasing pressure as global economic tensions increase, with UNISWAP (UNI) that experiences changes in dramatic prices that reflect broader uncertainty in the market.

The recent price range of 10.9% of the UNI demonstrates how geopolitical factors directly influence the valuations of digital assets, as merchants sail between the feeling of risk and opportunistic positioning.

Despite the challenging conditions, UNISWAP has shown resilience when breaking over the key levels of resistance, which suggests a potential stabilization after significant volatility.

TECHNICAL ANALYSIS

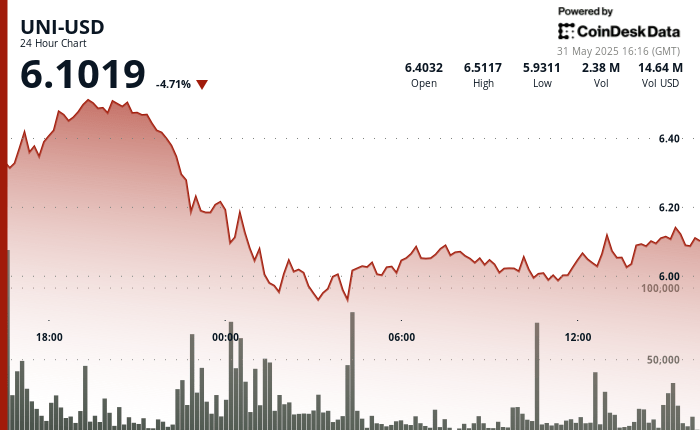

- UNI experienced a significant price turbulence during the 24 -hour period, with a substantial range of 0.644 (10.9%) from the maximum of 6,589 to the minimum of 5,945, according to the Coindesk Research technical analysis data model.

- The Token faced a strong sale during the period of 16: 00-01: 00, falling from 6,510 to 5,954, with a remarkably high volume (4.4m) at a minimum of 01:00, establishing a strong volume support zone.

- A modest recovery followed, with a search resistance of the UNI around 6,120 and consolidating between 6,000-6,050, which suggests market indecision after significant correction.

- In the last hour, Uni experienced a significant downward trend followed by a modest recovery.

- The Token decreased from 6,110 to a minimum of 6,017 around 13:51, establishing a key support zone with greater volume.

- A notable investment occurred at 14:01 when UNI increased 3.6% from 6,032 to 6,054, accompanied by a high volume (28.7k), which suggests a renewed purchase interest.

- The price action formed an upward channel with 6,055 resistance and support to 6,030, with the closing price of 6,051 that indicates a potential stabilization in the short term after the previous volatility.

External references