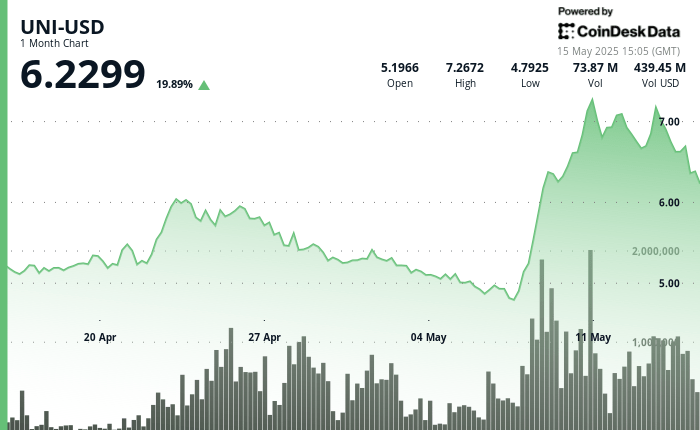

The cryptocurrency market is experiencing a significant turbulence as Uniswap’s Token Uni faces intense sales pressure.

After establishing resistance to $ 6,780, UNI in cascade down with multiple high volume sales periods, which broke below critical support levels, according to the technical analysis data model of Coindesk Research.

This volatility occurs when blockchain data reveal that the great institutional holders transferred substantial positions to centralized exchanges, with two directions that move 11.65 million tokens ($ 82.38 million) to Coinbase Prime.

TECHNICAL ANALYSIS

- UNI-USD decreased from $ 6,658 to $ 6,286, which represents a 5.59% drop in 24 hours.

- The Token established a clear resistance level to $ 6,780 during the time of midnight with high volume (2.02m).

- There were multiple high volume sales periods between 05: 00-07: 00 and again at 10:00, and the latter saw the highest volume of 24 hours (2.43m).

- The price broke below the critical support level of $ 6.30 during the high volume sale.

- The general negotiation range of $ 0.541 (8.12%) reflects greater volatility.

- In the last hour, the UNI experienced extreme volatility with a dramatic price collapse of $ 6,387 to a minimum of $ 6,239 (2.3%drop).

- There was a severe breakdown at 13:33 when the price collapsed 5.1% in a massive volume (48.8k).

- Even heavier, the sale at 13:48 (volume of 116.4k) led the university to its minimum per hour.

- A notable recovery arose in the final minutes, raising the price at $ 6,304, establishing a possible short -term support zone.

Discharge of responsibility: This article was generated with AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy. This article may include information from external sources, which are listed below when appropriate.

External references