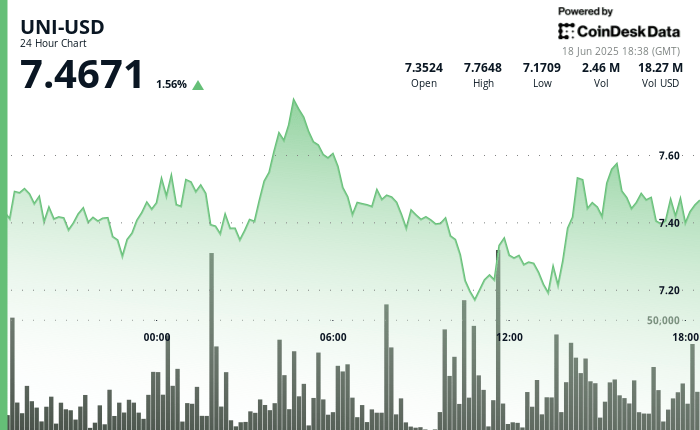

The Unisswap governance token continues its impressive return, quoting above $ 7.46 on Tuesday after gathering 70% of its annual minimum of $ 4,551 on April 7. The Token has registered seven weekly profits in the last eight weeks, its longer positive stretch from early 2023, now it is now firmly marketed above the key resistance levels that limited previous recovery attempts.

The broader structure now reflects a classic bullish reversal, with a prolonged descending tendency that gives way to acute rebounds, a strong support of support and improves the feeling around the governance and role of the UNISWAP market. Buyers absorbed an acute reduction previously in the session and quickly backed up, establishing a new base around $ 7.14– $ 7.17.

That support area now defines the lower limit of the Token negotiation range. The last rally saw the Token go through previous maximums despite some intradic profits near the $ 7.52 brand. The consistent pattern of higher minimums and a strong volume near the key inflection points indicates a potentially sustainable upward trend, although it is likely that a clean rest would be needed above $ 7.60 to confirm a complete impulse change.

TECHNICAL ANALYSIS

- UNI quoted in a 24 -hour range of $ 0.650, from $ 7,142 to $ 7,792, reflecting intradic volatility of 8.7%.

- A strong mass sale gave a fund to $ 7,142 during the 10:00 hours, with a volume of increase to 3.96 million, 78% above the daily average.

- The next hour saw the volume of volume to 4.69 million as the buyers in the vicinity, which caused a V -shaped recovery.

- The price reached $ 7,578 at 15:00 before facing the resistance and temporary consolidation.

- At 17:33, Uni went down to $ 7.37, followed by an increase between 17:37 and 17:39, with a volume increasing almost 3 times the average per hour.

- The price reached its maximum point at $ 7.53 during the wake of 18:00 with a volume of 162K, which represents a profit of 5.8% from the minimum of the hour.

- Despite some profits about $ 7.52, the price action remained above the average range, extending recovery to a more defined upward trend.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.