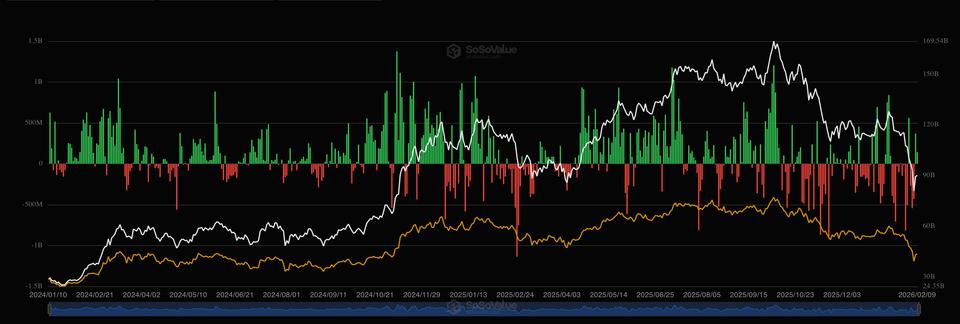

For the first time in almost a month, US bitcoin exchange-traded funds (ETFs) recorded consecutive net inflows, breaking a streak of redemptions dating back to mid-January.

According to SoSo value data, the change of consecutive entries began on Friday with $471.1 million of fresh capital, followed by $144.9 million on Monday. This comes as bitcoin recovered from Thursday’s low of $60,000 to around $70,000.

In mid-January, bitcoin hit a high near $98,000 after a two-week rally that started at $87,000. The subsequent sell-off to $60,000 caused investors to withdraw millions from these ETFs in cash.

Generally speaking, investors still seem confident in the cryptocurrency’s long-term prospects, as evident from the spot on ETFs’ resilient assets under management (AUM).

According to Checkonchain, the cumulative AUM of the 11 funds has only decreased by approximately 7% since the beginning of October, going from 1.37 million BTC to 1.29 million BTC. Meanwhile, Bitcoin has fallen more than 40% since hitting all-time highs above 126,000 in October.