The United States Public Future Trade Commission (CFTC) said it is looking to allow the trade of spot cryptography contracts in registered exchanges and is looking for contributions from interested parties, since it seeks to implement the cryptographic ambitions of President Donald Trump.

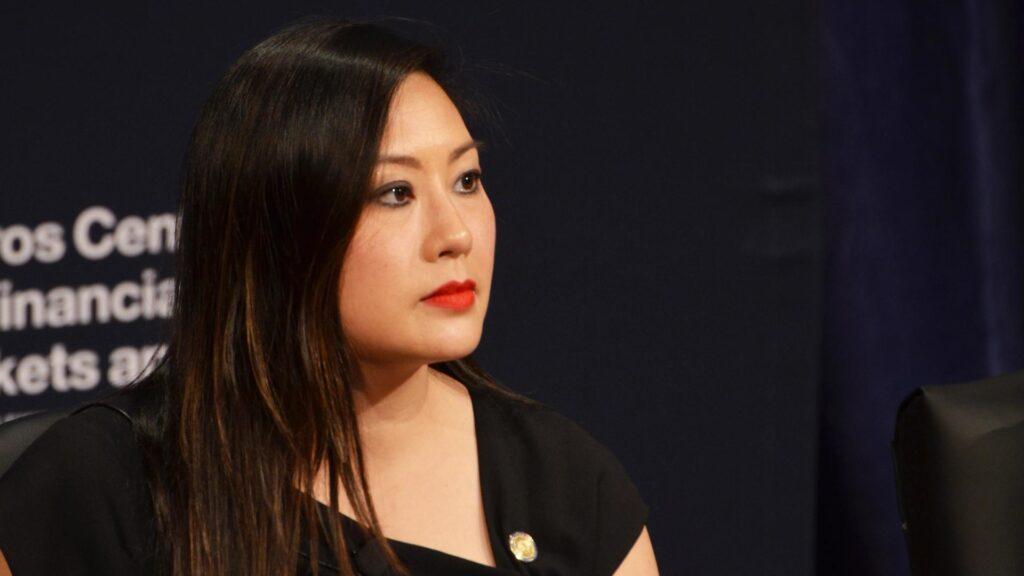

The agency wants interested parties to work with it to provide regulatory clarity on the list of cryptographic asset contracts in an exchange of CFTC registered futures, also known as a designated contract market (DCM), one of the types of licenses that CFTC manages, said Interim President Caroline Pham in a Monday statement.

“As of today, we invite all interested parties to work with us to provide regulatory clarity on how to list cryptography assets contracts in a DCM using our existing authority, as I have previously proposed since 2022,” said Pham. “Together, we will make the United States the cryptographic capital of the world.”

The “Crypto Spot Commerce Initiative” is the first step that the CFTC has given in response to Trump’s working group on the report of digital asset markets that was published last week. The report established expectations for US regulators.

Join the cryptography policy conversation on September 10 in DC – register now to COINDESK: Politics and regulation.

The initiative is also part of the “Crypto Project” of the Commission of Securities and Securities, which is an initiative of the entire commission that aims to modernize the rules of values so that the financial markets can go to the block chain, the technology that supports Crypto, said the president of the SEC, Paul Atkins, in a statement last week.

“Under the strong leadership and vision of President Trump, the CFTC is at full speed ahead to allow the immediate trade of digital assets at the federal level in coordination with the Crypto project of the SEC,” Pham said.

Interested parties are encouraged to present their suggestions on August 18 on August 18.

The Congress is also working to specify which roles the CFTC and SEC should have to supervise the cryptography, with the market structure legislation, such as the clarity law of the House of Representatives, with the aim of making the Basic Products Regulator the supervisor of the main main market for Crypto.