The crypto sector has been freed from its annual benchmark in the litany of financial risks that the Financial Stability Oversight Council poses to the American system, although it is not alone in that, because the report has effectively removed much of its focus on the “vulnerabilities” of the financial system.

The FSOC, established after the 2008 mortgage crisis that plunged the global economy, was intended to be an early warning effort in which the council of regulatory chiefs tries to collectively detect looming dangers. The digital asset industry was an annual item on that list, although reports always noted the still-limited size of the market while also suggesting that products like stablecoins and exchange-traded funds could pose risks if the space became too interconnected with the rest of the financial system. That is no longer an explicit concern in the 2025 report released Thursday by President Donald Trump’s regulators.

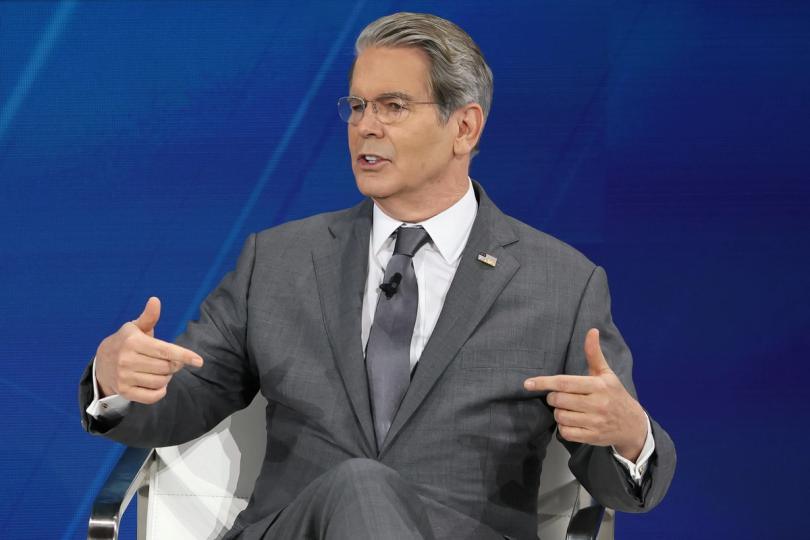

The document’s index has completely erased the once-ubiquitous word “vulnerabilities,” and Treasury Secretary Scott Bessent acknowledged in the report’s opening letter that the analysis historically focused on identifying dangers that could disrupt the financial system.

“But monitoring and addressing these vulnerabilities, although important, is not enough to safeguard financial stability,” he said. “Financial stability also requires and is interdependent on long-term sustainable economic growth and economic security.”

The 2024 report, a 140-page document written under the supervision of regulators in former President Joe Biden’s administration, had primarily focused its recommendations on digital assets on pushing Congress to regulate stablecoins and assigning specific regulations to spot markets. This year’s shorter report, at 87 pages, does not include “recommendations” on digital assets or flag explicit concerns about the industry.

In the digital assets section, it has a “further actions” subsection that refers to this year’s President’s Task Force report on U.S. crypto activity and the administration’s agenda, noting that the previous report “contains recommendations for Congress and various government agencies, including certain council member agencies, to enable American innovation and leadership in digital financial technology.”

The digital assets sections of the 2025 FSOC report detail how US financial regulators with a say in crypto matters retreated from their previous policy stance in which they typically warned regulated financial firms about the risks of getting involved in the industry and sometimes stood in the way. He primarily praises the strengths of the growing sector, although he notes in the “illicit finance” subsection that stablecoins can be “abused to facilitate illicit financial transactions.”

However, he also said that “the continued use of US dollar-denominated stablecoins is expected to support the role of the US dollar in the international financial system over the next decade.”

Read more: FSOC remains concerned about stablecoins