Listed US crypto mining companies doubled their bitcoin (BTC) holdings last year, bringing the total to 92,473 valued at $8.6 billion as of the end of December, while the price of the largest cryptocurrency surged 120%. , according to data from TheMiningMag.

The largest amount, almost half of the total, is held by MARA Holdings (MARA) with 44,893 BTC. MARA has the second largest stock among publicly traded companies, surpassed only by MicroStrategy’s (MSTR) 450,000 BTC.

The strategy of investing in bitcoin and holding it for the long term, known as HODL after a typo made more than a decade ago, has gained popularity in the last 12 months.

Three other miners hold more than 10,000 BTC: Riot Platforms (RIOT) with 17,722 BTC, Hut 8 (HUT) with 10,171 BTC, and CleanSpark (CLSK) with 10,097 BTC, according to Bitcoin Treasurys.

Not all miners subscribe to the HODL manual. IREN (IREN), TeraWulf (WULF), and Core Scientific (CORZ) hold very few or no bitcoins. Due to the competitive nature of the business, these companies have pivoted towards the artificial intelligence (AI) and high-performance computing (HPC) industries.

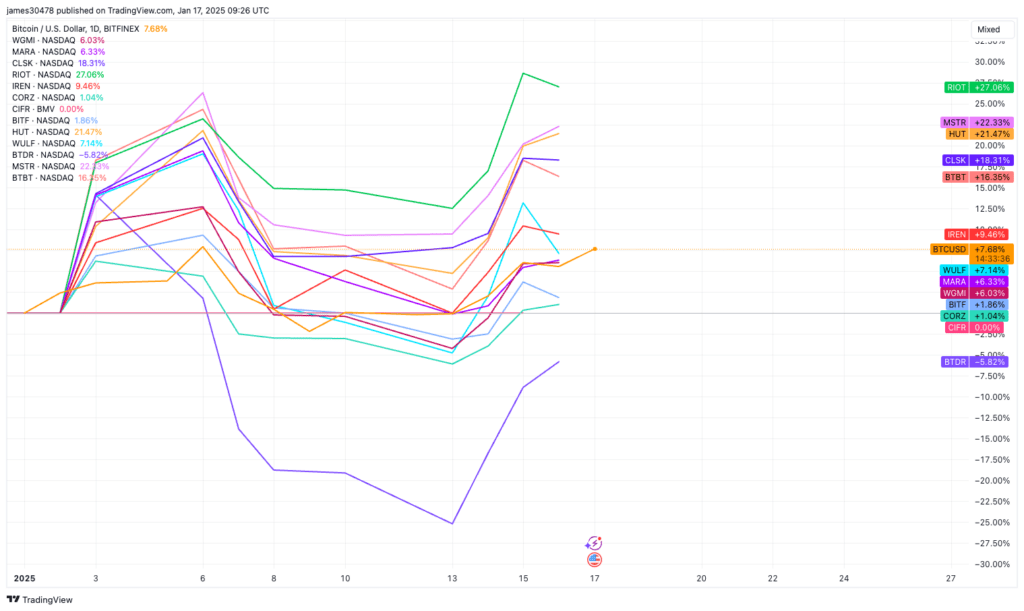

Stock prices have not followed the trajectory of bitcoin. Overall, miners underperformed bitcoin and other cryptocurrency-related stocks, such as MicroStrategy. Prominent Core Scientific and Terawulf, with their new focus on AI, saw returns of over 300%.

This year, however, miners who HODL bitcoin have benefited greatly, with RIOT, HUT, and CLSK outperforming bitcoin. Only Bitdeer (BTDR) has generated negative returns, after seeing strong performance in 2024.