USD.AI Stablecoin protocol, which provides credit to artificial intelligence (AI) Companies have raised $ 13 million in Funds from Serie A led by Framework Ventures.

USD.AI, developed by Permian Labs, issues loans to emerging companies using a graphics processing unit (GPU) Hardware as a collateral, reducing approval times by more than 90% compared to traditional lenders. The system in the chain includes the USDAI, a dollar token and itsai, a performance version backed by computing assets generating income.

GPUs are fundamental hardware for AI processes by carrying out the many calculations at the same time required to make the training process and the use of AI models much faster.

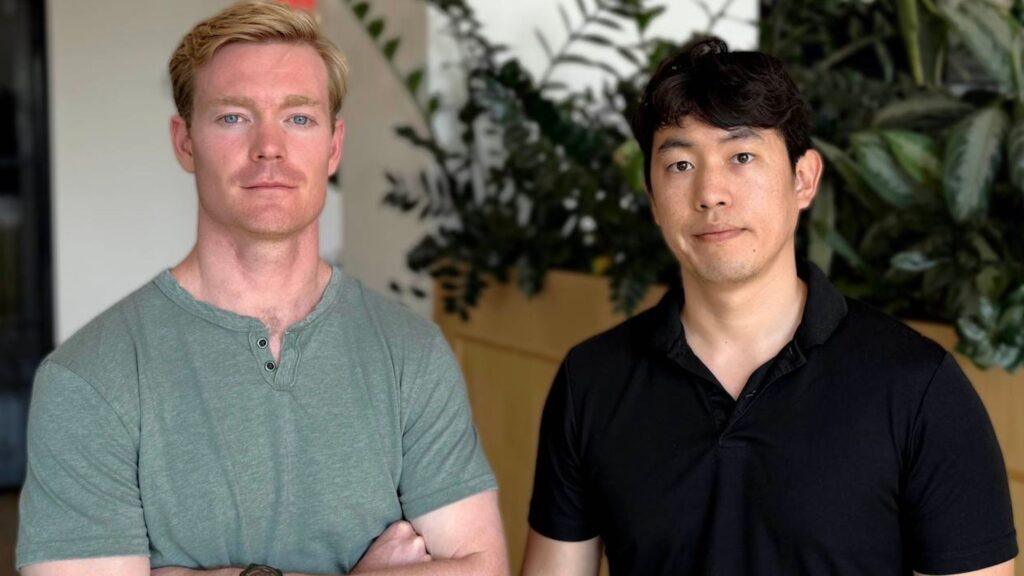

CEO David Choi said that the USD.AI model “treats GPUs as basic products,” which allows rapid programmatic loan approvals without a conventional guard, in a shared announcement with Coindesk on Thursday.

Vance Spencer of Framework compared the capital demands of AI with the “oil boom” and said that USD.AI could democratize access to financing while offering the performance of investors linked to the growth of the AI sector.

With $ 50 million already in deposits during the private beta version, USD.AI plans a public launch with an ICO and a game -based allocation model.

USD.AI can represent the potential of a convergence between the stable, which have been at the forefront of regulatory advances in digital assets, and the AI that has quickly ascended to conventional adoption in recent years.

Together, the two could create a smarter and more efficient financial system. This synergy allows agents to perform transactions autonomously and reliable using a stable currency, improving financial automation, safety and risk management in various applications, from payments to decentralized finances.

CORRECTION (August 14, 13:20 UTC): Eliminates the incorrect mention of the participating investors of the section “What to know”