By Omkar Godbolole (all time and unless otherwise indicated)

The encryption market is treading water and the largest cryptocurrency, Bitcoin, is taking a bull respite. His ascending impulse is being suffocated by renewed Trump tariff threats, which are also sending the prices of upward gold to record the maximums and underpin the demand of the US dollar.

But there is action in some corners of the market. The Virtual Token appeared after its recent list in Upbit, and Hyperliquid’s hype token has seen a 3%gain. Litecoin is also making waves, with its future perpetuals open of interest in centralized exchanges that rise to 5.19 million LTC, the greatest amount since December 9, according to Coinglass. The wave suggests a new capital that flows to the market, probably fed with the hope of an ETF spot list in the United States.

Speaking of Stablecoins, the USDC is stealing the center of attention as the star artist this month, with a remarkable growth of market capitalization from 21% to $ 53.12 billion. That is its best month since May 2021, according to TrainingView data. On the contrary, the USDT, the heavyweight champion of the stable of Dollar Pugged, obtained only a 1%increase. The USDC even exceeded Bitcoin, which grew by 10%respectable.

According to Intotheblock, the upper performance of the USDC is probably due to compliance with the regulations of Mica in Europe, while rivals such as the USDT face winds against and winds against. But don’t tell the USDT; Its market is beginning to recover, and the simultaneous growth of the USDC is offering an upward boost for the cryptographic market.

As we monitor the macro landscape, the fundamental PCE of the United States, the reference reference measure for inflation, will be launched. The expectations are for a number of Hot headline, with a central reading, which excludes food and energy, showing positive improvements that could help BTC out of their boring price action about $ 104,000.

However, ING warns that the dollar could stay strong in the weekend.

“If we do not receive any news about Canada and Mexico at the end of today, there is a risk that the dollar can be strengthened even more as the market begins to set the price at a greater possibility that the tariffs are announced tomorrow,” he wrote . So stay alert!

What to see

- Crypto:

- January 31: Crypto.com suspends the purchases of USDT cryptocurrencies, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO and XSGD in the EU to comply with the Mica Regulations. The withdrawals will be supported until q1.

- February 2, 8:00 pm: Core Blockchain Athena Hard Fork Network Update (V1.0.14)

- February 4: Pepecoin (Pepe) in half. In block 400,000, the reward will fall to 31,250 PEPE.

- February 5, 3:00 PM: The update of the Holocene Holocene Network fork network for its Ethereum-based Mainnet Mainnet.

- February 5 (after market closure): Microstrategy (MSTR) T4 Fy 2024 profits.

- February 6, 8:00 am: Update of the SHENTU chain network (V2.14.0).

- February 11 (after market closure): Exodus movement (exod) P4 2024 profits.

- February 12 (before the open market): Hut 8 (HUT) P4 2024 profits.

- February 13: Cleanters (CLSK) Q1 FY 2025 profits.

- February 13 (after market closure): Global Coinbase (COIN) Q4 2024.

- February 15: Qtum (Qtum) Hard fork Network Current in block 4,590,000.

- February 18 (after market closure): Semler Scientific (SMLR) Q4 2024 profits.

- February 20 (after market closure): block (xyz) Q4 2024 profits.

- February 26: Mara Holdings (Mara) P4 2024 profits.

- February 27: Riot Platforms (Riot) P4 2024 profits.

- March 4: The liberations of encryption mining (enc) T4 2024 profits.

- Macro

- January 31, 8:30 am: The United States Economic Analysis Office (BEA) publishes the December Personal Report and the Disbursement Report.

- Core PCE Price Index Mom Est. 0.2% vs. Prev. 0.1%.

- Central PCE Price Index Yoy Est. 2.8% vs. Prev. 2.8%.

- PCE Price Index Mom Est. 0.3% vs. Prev. 0.1%.

- PCE Price Index Yoy Est. 2.6% vs. Prev. 2.4%.

- February 2, 8:45 pm: China Caixin launches the PMI manufacturing report of January.

- PMI manufacturing est. 50.5 vs. Prev. 50.5.

- January 31, 8:30 am: The United States Economic Analysis Office (BEA) publishes the December Personal Report and the Disbursement Report.

Token events

- Government votes and calls

- The DAO compound is voting in an update of its governance contracts from governing to the modern implementation of the Governor of Openzeppelin.

- Balance Dao is voting whether to start an exchange of tokens between the DAO balancer and the DAO cow that involves 200,000 tokens bal and about 631,000 cow tokens.

- You unlock

- January 31: Optimism (OP) to unlock 2.32% of the circulating offer worth $ 46.39 million.

- February 1: SUI (SUI) will unlock around 2.13% of its circulating supply for a value of $ 261.91 million.

- February 2: Ethena (ENA) will unlock around 1.34% of its circulating supply for a value of $ 29.53 million.

- Tokens listings

- January 31: Movement (Move), virtual (virtual) and surf (surge) that will be listed in Indodax.

Conferences:

Derivative positioning

- Trx, Trump and OM registered the greatest increase in future perpetuals of interest. The merchants, however, seem to be shortened to Trump, as is evident by the delta of the negative cumulative volume.

- BTC, Eth Open Interest and CVD are little changed. The BTC CME base is around 10%.

- The flows in the detribity options have been silenced, but the calls of BTC and ETH continue to operate more expensive than the PUT.

Market movements:

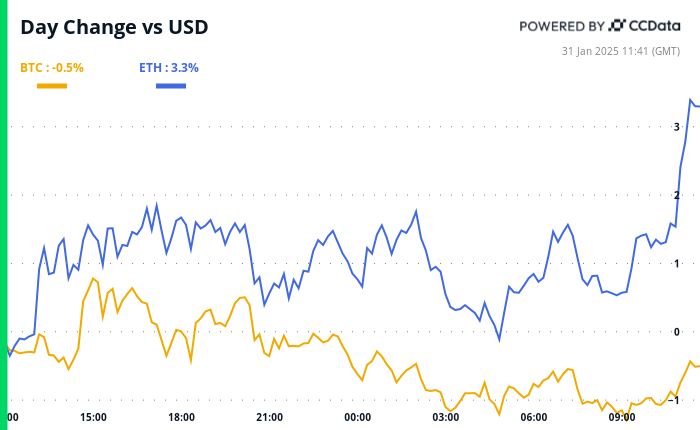

- BTC has dropped 0.29% of 4 PM ET on Thursday to $ 104,810.50 (24 hours: -0.47%)

- ETH increases 2.39% to $ 3,324 (24 hours: +3.32%)

- COINDESK 20 has dropped 0.3% to 3,838.81 (24 hours: +0.28%)

- The commitment rate composed of CESR rises 4 BPS to 3.07%

- The BTC financing rate is at 0.0012% (1,2961% annualized) in OKX

- DXY increases 0.47% to 108.30

- Gold has not changed to $ 2,794,77/oz

- La Plata rises 0.19% to $ 31.60/oz

- Nikkei 225 closed +0.15% at 39,572.49

- Hang Seng closed +0.14% at 20,225.11

- Ftse increases 0.3% to 8,673.13

- Euro Stoxx 50 has increased 0.39% to 5.302.75

- Djia closed Thursday +0.38% to 44,882.13

- S&P 500 closed +0.53% at 6,071.17

- Nasdaq closed +0.25% to 19,681.75

- S&P/TSX CLOSED COMPOSIT +1.31% at 25,808.25

- S&P 40 Latina America closed +2.21% to 2,388.03

- The 10 -year Treasury of US

- E-mini s & p 500 Futures rose 0.43% to 6,125.75

- E-mini nasdaq-100 futures rose 0.79% to 21,795.50

- E-mini dow Jones The industrial average of the index has increased 0.32% to 45,200.00

Bitcoin statistics:

- BTC domain: 59.21 (-0.11%)

- Bitcoin Ethereum Relationship: 0.03127 (0.84%)

- Hashrat (seven -day mobile): 781 eh/s

- Hashprice (spot): $ 61.7

- Total rates: 4.97 BTC/ $ 522,698

- CME Futures Open Interest: 176,270 BTC

- BTC with a gold price: 37.3 oz

- BTC vs Gold Market Cap: 10.60%

Technical analysis

- The graph shows that $ 60 has become a strong resistance for the Blackrock Exchange Ibit since December, and bulls fail to establish a support point above that level.

- Such patterns represent bullish exhaustion often rule the way for lower price setbacks that shake weak hands, preparing the stage for the next higher leg.

Cryptographic equities

- Microstrategy (Mstr): closed on Thursday at $ 340.09 (-0.34%), 0.2% higher than $ 340.77 in the previous market.

- Global Coinbase (COIN): Closed at $ 301.30 (+3.54%), 0.17% to $ 300.80 in the previous market.

- Galaxy Digital Holdings (GLXY): closed to C $ 29.33 (+0.83%).

- Mara Holdings (Mara): closed at $ 19.18 (+4.13%), 0.36% more at $ 19.25 in the previous market.

- Riot platforms (Riot): closed at $ 11.90 (+6.06%), 0.76% more at $ 11.99 in the previous market.

- Core Scientific (Corz): closed at $ 12.26 (+6.98%), a 3.18% increase to $ 12.65 in the previous market.

- CleanSTark (CLSK): closed to $ 10.97 (+6.92%), 0.55% more at $ 11.03 in the previous market.

- Coinshares Valkoie Bitcoin Miners ETF (WGMI): closed at $ 22.50 (+6.33%), an increase of 3.47% to $ 23.28 in the previous market.

- Semler Scientific (SMLR): closed at $ 52.15 (+0.13%).

- Exodus movement (Exod): closed to $ 61.38 (-31.27%), less than 2.23 %% to $ 60.01 in the previous market.

ETF flows

ETF flows

Spot BTC ETF:

- Daily net flow: $ 588.2 million

- Cumulative net flows: $ 40.18 billion

- Total btc holdings ~ 1.18 million.

Spot Eth Ethfs

- Daily net flow: $ 67.77 million

- Cumulative net flows: $ 2.73 billion

- Total eth holdings ~ 3.65 million.

Source: Farside Investors

Flows during the night

Figure of the day

- The movement index, which represents a measure based on options of how volatile it is likely to become the United States treasure market in the next four weeks, has been reduced.

- The decrease in treasure market volatility is often a good omen for risky assets.

While you sleep

- Bitcoin stable, gold chips shine when Xau reaches a record; Inflation in Tokyo Rises (Coindesk): The tariff threats of President Trump are a wind against Bitcoin, but derivative data indicate skepticism towards a great recession, with merchants that remain optimistic and growing interests in BTC reserves at the level at level state.

- Grayscale files the SEC’s proposal to convert XRP Trust into ETF (COINDESK): Thursday, Nyse Arca presented a 19B-4 form with the SEC to enumerate the actions of Grayscale’s XRP Trust as ETF.

- Virtual increases 28% as the UPBIT list exposes the token to the South Koreans experts in Altcoin (Coindesk): the price of the virtual, the native token of the Virtual protocol the token.

- Trump is obtaining the lowest interest rates that he demanded to all except the Fed (Reuters): despite Trump’s calls to tariff cuts, the Fed is still aggressive, while the Bank of Canada, the Bank of England and the European Central Bank are relieving monetary policy.

- Trump says that 25% tariffs in Mexico and Canada may not include oil (CNBC): Trump confirmed Thursday that 25% of the fees on Mexican and Canadian imports will begin on February 1, but they will leave uncertain oil.

- Japan’s economy faces consequences of Trump’s tariff threats (Bloomberg): Japan’s chief economist, Volume Hayashi, said that a commercial war between the United States and China could damage the economy of their country, although he believes that companies They are better prepared now than during Trump’s first mandate.

In the ether