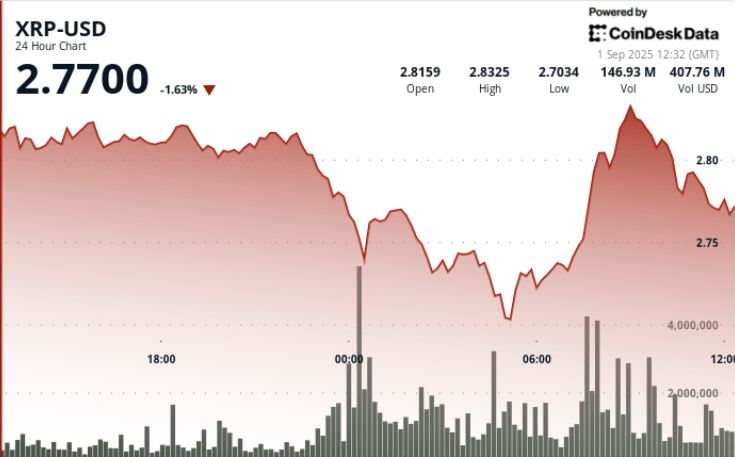

Token quote between $ 2.70– $ 2.84 on August 31 to September. 1 window, with accumulation of whales that counteracts strong resistance to $ 2.82– $ 2.84.

News history

- XRP fell from $ 2.80 to $ 2.70 at the end of August 31, mainly on September 1 before recovering at $ 2.82 in heavy volumes.

- Accumulated whales 340m XRP for two weeksan institutional condemnation signal despite the low -term bearish pressure.

- Activity in the augmented chain with 164m tokens negotiated during the morning rebound on September 1more than averages of double session.

- September remains historically weak for cryptography, but the accumulation of whales looks like a counterweight to retail settlement flows.

Summary of the price action

- The negotiation range covered $ 0.14 (≈4.9%) Between $ 2.70 minimum and $ 2.84 high.

- The most steep decrease occurred at 23:00 GMT on August 31, since the price was reduced from $ 2.80 to $ 2.77 in 76.87m Volumealmost 3 times averages daily.

- At 07:00 GMT of September 1, the bullish flows were a rebound of $ 2.73 to $ 2.82 in 164 m volumecementing $ 2.70– $ 2.73 as short -term support.

- Consolidation of the final time (10: 20–11: 19 GMT) The price of the mountains slides 0.71% of $ 2.81 to $ 2.79, with a heavy sale between 10: 31–10: 39 in 3.3m volume per minuteconfirming resistance to $ 2.80– $ 2.81.

Technical analysis

- Support: $ 2.70– $ 2.73 repeatedly defended, reinforced by the purchase of whales.

- Endurance: $ 2.80– $ 2.84 is still the rejection zone, with $ 2.87– $ 3.02 as the next rise threshold.

- Impulse: RSI near the mid -40 after the rebound, showing neutral cargo bias.

- Macd: The compression phase continues; Potential crossover If accumulation persists.

- Patterns: Formation of the symmetrical triangle with volatility compression; The rupture route remains open to $ 3.30 if the resistance is erased.

What merchants are seeing

- If $ 2.70– $ 2.73 is maintained, the short -term merchants will treat it as a springboard for $ 2.84 reestations.

- A closure above $ 2.84 would put $ 3.00– $ 3.30 at stake.

- Disadvantage scenario: Failure to comply with $ 2.70 exposes $ 2.50 as the following structural support.

- Accumulation of whales versus Institutional Sale: The thrust dynamics that the September Directorate could dictate.