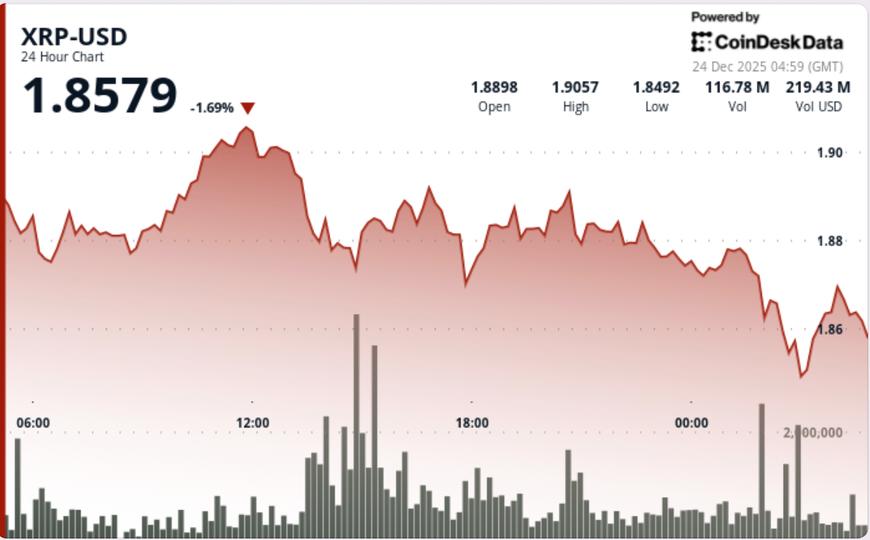

XRP fell through short-term support on Wednesday as sellers reappeared near $1.90, keeping the token pinned in an increasingly tight range and pushing attention towards the $1.85 area.

News background

The move comes as crypto markets remain volatile in the year-end window, when liquidity often declines and positioning tends to dominate price action. Traders have been leaning toward short-term risk control rather than directional conviction, particularly after recent sharp moves in major currencies.

XRP has also been operating against a backdrop of mixed signals from the analyst community. Some chart watchers have pointed to a rising wedge structure that could pressure price lower if support continues to erode, while others point to RSI divergence patterns that often appear near local exhaustion points. That split has kept conviction low and strengthened the market’s tendency to fade rallies near obvious resistance.

Technical analysis

XRP spent most of the session using the band between $1.8615 and $1.8700 as a functional support zone, but late selling of the session pushed the price below that floor and into a lower distribution range.

The key was the concentration of volume in the resistance. Trading peaked at around 75.3 million tokens during the rejection near $1.9061, almost double the 24-hour average, suggesting that larger players were active on the sell side to build strength rather than stepping in to accumulate.

On an intraday basis, the breakout from around $1.878 to mid-$1.86 came with repeated volume spikes, including a burst of 2.7 million during the drop from $1.867 to $1.865, reinforcing that the breakout was driven by flow, not just drift.

Price Action Summary

- XRP fell from $1.8942 to $1.8635 in 24 hours

- Resistance held near $1.9061 at the highest volume of the session.

- The support band between $1.8615 and $1.8700 was broken late, shifting the price to a lower range

- Trading remained contained overall, with a range of $0.0395 (about 2.1%)

What traders should know

$1.87 has gone from a support level to a short-term decision level. If XRP can reclaim that zone and hold it, the move is more consistent with a reestablishment of the range and a possible pullback towards $1.90-$1.91. Otherwise, the next area that traders will focus on is between $1,860 and $1,855, where buyers are expected to defend themselves to avoid a deeper decline.

For now, the pattern remains “sell rallies to $1.90, buy dips near $1.86,” and the next directional move will likely depend on whether volume expands on a breakout, not another test of low liquidity within the range.