The alarm is increasing on the possible withdrawal of Washington from the global institutions, including the International Monetary Fund and the World Bank, with the non -show of the United States Secretary of the Treasury, Scott Besent in the G20 meetings, increasing anxiety. So what are the IMF and the World Bank and what happens if the United States retires from them?

What do the IMF and the World Bank do?

The United States and its allies formed the two institutions in the ashes of World War II to promote global integration and future forest wars.

The IMF is a lender of the last resort to the countries in trouble: from Greece during its financial crisis, Argentina amid successive breaches of debt and even the United Kingdom after an economic crisis of 1976.

Loans range from emergency cash to address payment balance crises to caution lines to avoid a crunch.

Attached conditions to loans, sent in sections, to ensure that countries promulgate reforms, which generally require cuts to waste expenses, more transparent budgets, enincy about corruption or increase tax revenues. Investors use IMF data on GDP and growth such as trigger to determine whether certain debt instruments that link payments with economic performance give them more money, or sometimes less money.

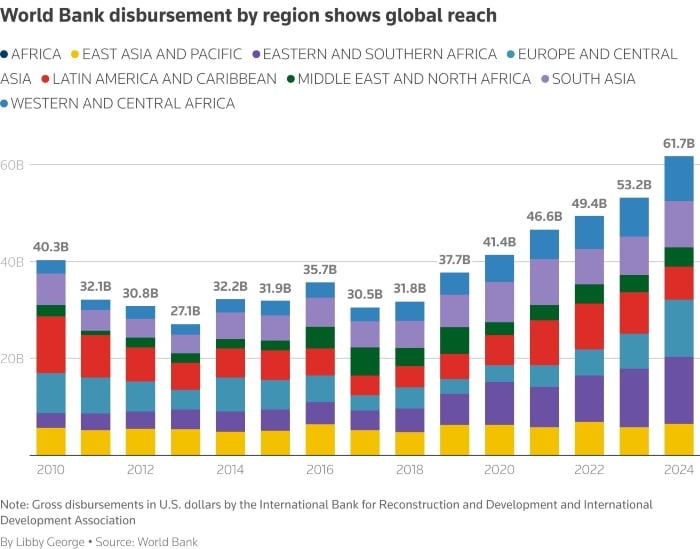

The World Bank lends itself to low rates to help countries build everything from railways to flood barriers, creates necessary frameworks for innovative financial tools, such as green bonds and provides risk insurance.

Both lenders provide experience in problems, from irrigation to the transparency of the Central Bank.

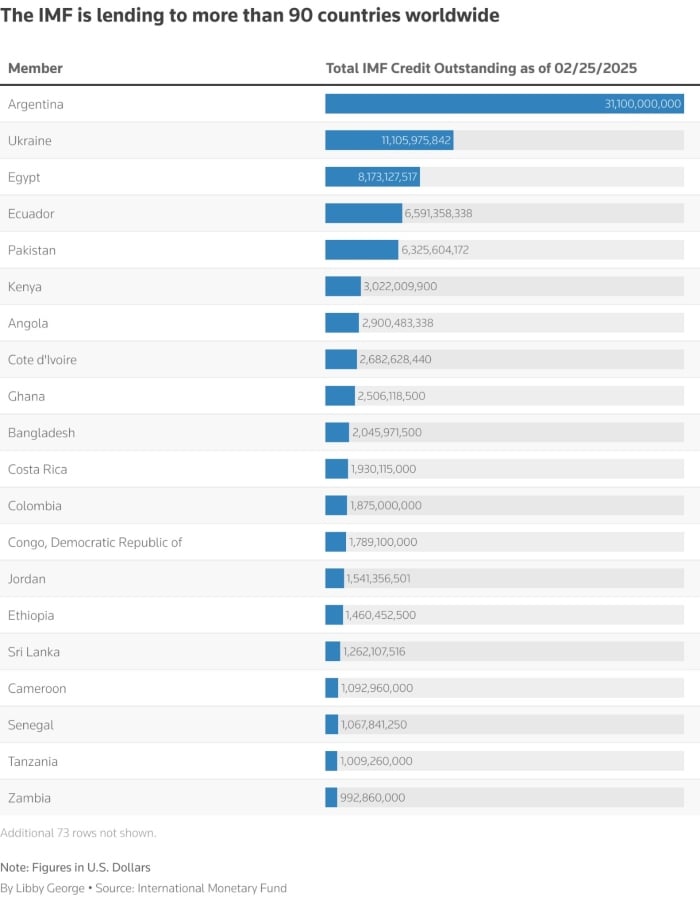

Who needs the IMF?

A strip of emerging market countries depends largely on the IMF: Argentina could not pay government workers without it, and others from Senegal to Sri Lanka also currently have their cash.

Having an IMF program also assaults investors, both private and bilateral.

“The IMF has long been an anchor specifically for debt investors,” said Yerlan Syzdykov, head of emerging markets at the largest asset manager in Europe, Amundi, added the experience of the United States, and not only money, gives investors confidence in the countries of the IMF countries.

Bilateral investors such as Saudi Arabia also consider the IMF as an anchor for their loans. The Minister of Economy, Faisal Alibrahim, said that it links loans to the institutions, including the IMF said “more value, of each dollar, each Riyal, which is dedicated to supporting other economies.”

What about the World Bank?

Investors work in close collaboration with the World Bank Private investment arm, the International Finance Corporation, co -infection in public/private associations for countries that seek the estimated billion dollars necessary for cleaner energy and infrastructure.

The developed countries that finance institutions, including the United States, have used them to guarantee world financial stability and encourage countries to adhere to fiscally responsible open economic models.

Both institutions, at the request of their largest shareholders, the United States, had backed countries such as Egypt, Pakistan and Jordan, where the United States has strategic interests, said Mark Sobel, president of the United States of the Official Forum of Monetary and Financial Institutions (OMFIF), an officer of the Board of the Department of the Treasury of Veterans and member of the IMF Board.

“If there is economic instability abroad, you can damage the economy of the United States,” Sobel said.

Does the developing world want them?

The IMF often gains the anger of protesters for advocating the painful unpopular reforms to balance budgets, such as reducing fuel subsidies or increasing tax revenues.

Some Kenians denounced the IMF during mortal protests last summer, while the response of the fund to the 1997 Asian financial crisis was flatly criticized.

But only a few countries, such as Cuba, North Korea and Taiwan, are not members of the IMF.

What happens if the United States takes your support?

“It would be a disaster,” said Kaan Nazli, manager of the Debt portfolio of the emerging market of Neuberger Berman.

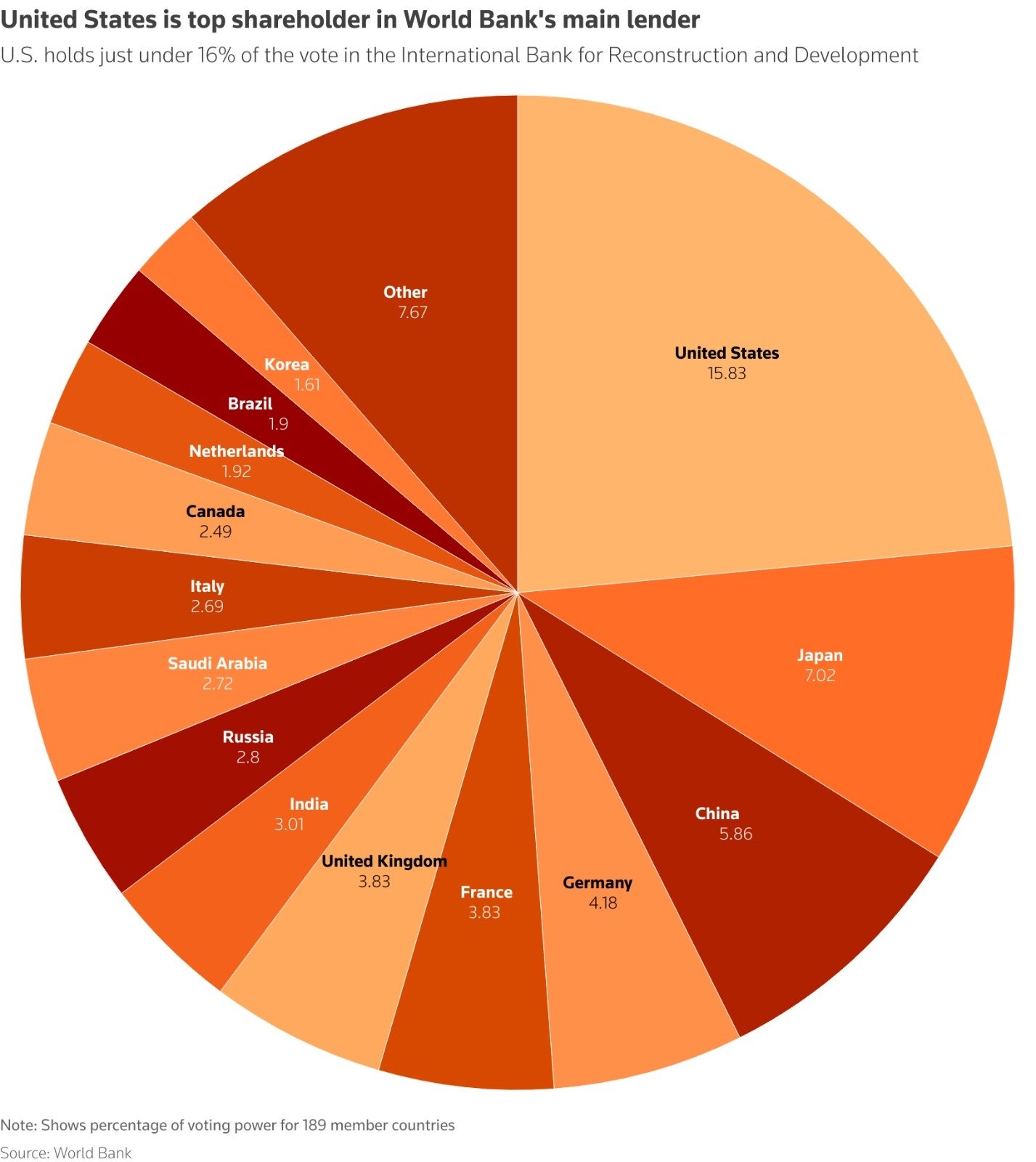

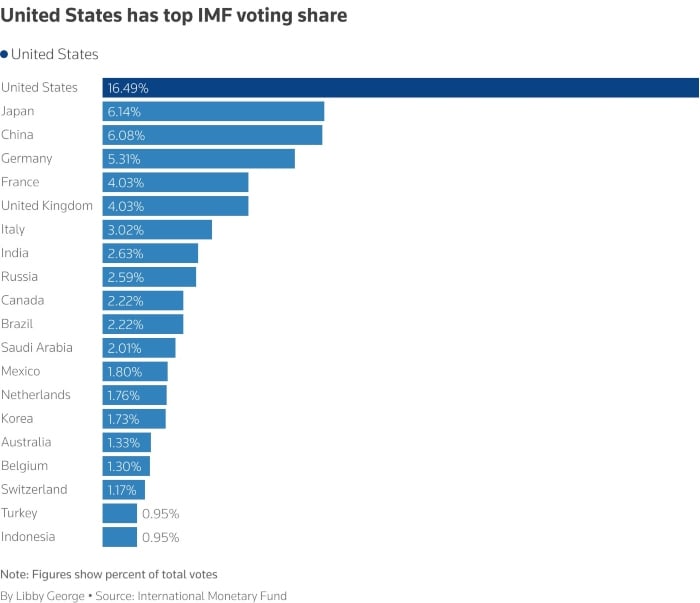

Founding member, the United States has the greatest individual participation of each institution, a little more than 16% for the IMF and just under that for the World Bank. This has given the political leaders of the United States a strong influence on decision making in which global economic leaders have trusted.

The withdrawal of the United States would also surprise experts and investors, since institutions give Washington that influence a relatively low cost. That said, it would be a gift for China and others that seek to evict it as the world leader.

Other countries could fill the financial vacuum; China has been interested in a more important role in global groups. He has pressed for a realignment of IMF participations and to strengthen the voices of emerging markets. China’s current participation is just over 5%.

An American departure “would be a great blow to its operation, and would only help China,” Sobel said.

In the World Bank, US companies would have less access to contracts and work funded by the group. A change in the structure of the IMF shareholders would change the power balance, making the decisions less predictable and potentially less transparent.

The lost access to the experience of the United States Treasury officials could undermine confidence, and grades agencies have warned that the US retirement could put at risk the coveted credit ratings of multilateral lenders, which limits their ability to provide.