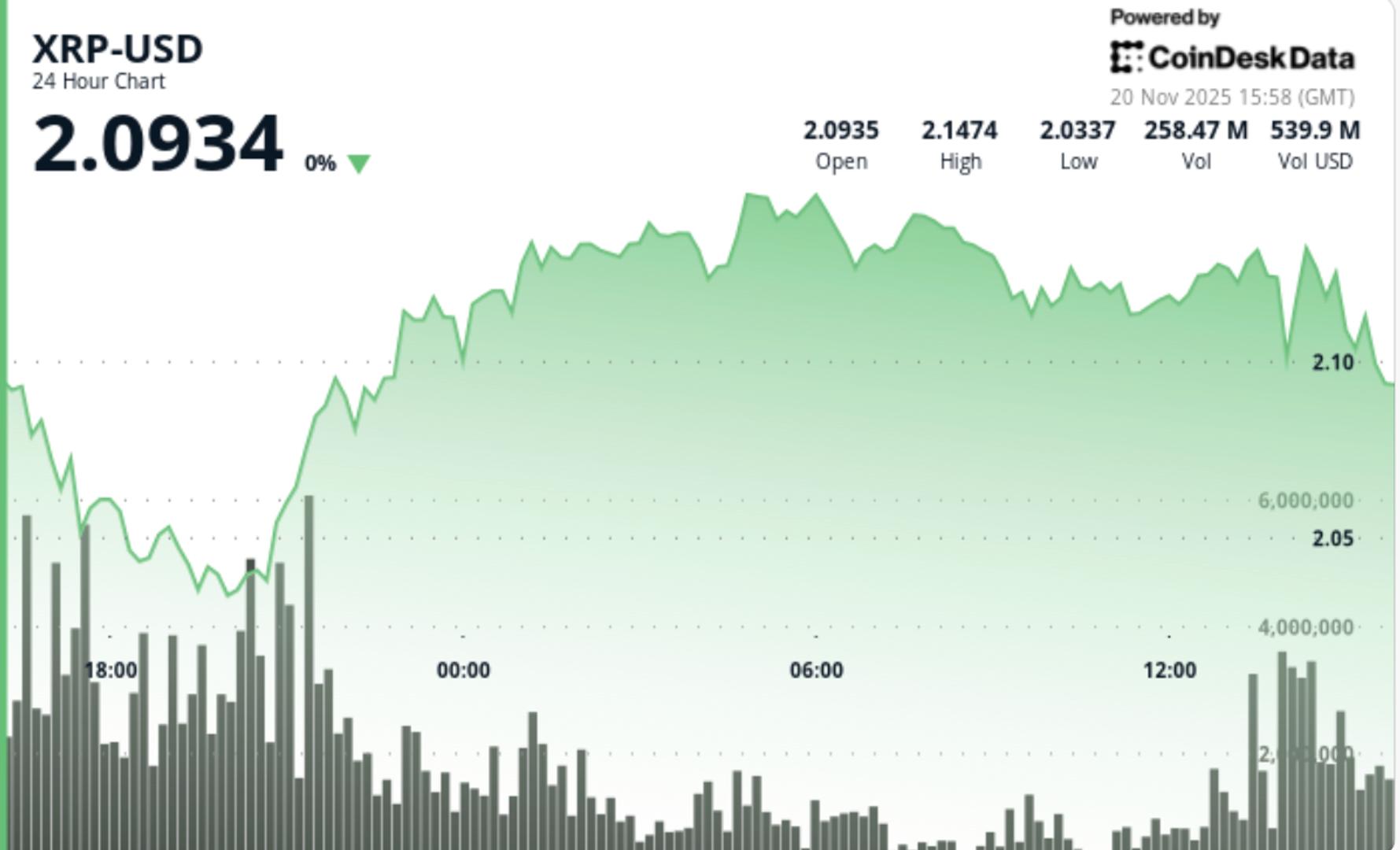

The token pierced the critical $2.10 floor during late session selling as traders exited positions ahead of a possible deeper correction.

News background

• XRP traded within a volatile range of $2.03 to $2.15 as broader crypto markets weakened under macro pressure

• The token’s strong rebound from $2.03 came amid a 28% volume increase, indicating active buying on dips before momentum faded.

• Multiple failed attempts to recover the zone between $2.14 and $2.15 limited the upside throughout the session

• Market sentiment remains fragile as Bitcoin death cross and heavy ETF outflows weigh on altcoins

• Institutional activity slowed sharply in the final hour of trading as XRP broke through the widely-watched support level of $2.10.

Price Action Summary

XRP fell 1.0% from $2.13 to $2.11 during the last 24-hour session, cruising in a range between $2.03 and $2.15. The token initially showed resilience in the face of broader market weakness, but bullish momentum steadily deteriorated.

The most significant move occurred at 21:00 UTC when a volume increase of 177.9 million occurred.28% above the 24-hour average—Help XRP recover sharply from $2.03. However, the recovery repeatedly stalled at the $2.14 to $2.15 resistance band. A pattern of lower highs developed as sellers absorbed each breakout attempt.

The session ended with a decisive breakout: XRP fell from $2,124 to $2,103 as heavy selling volume arrived. The drop passed cleanly through the $2.10 critical supportlevel that had been maintained for several sessions.

Liquidity at the end of the session collapsed, indicating that institutional traders stepped aside ahead of a possible continuation of selling.

Technical analysis

The XRP chart structure turned firmly bearish as breakout signals accumulated on the intraday time frames.

Support and resistance dynamics

The loss of $2.10 turned previous support into immediate resistance. Meanwhile, the market is now oriented around the cycle low in $2.03which formed during the high volume rejection at the beginning of the session. The inability to recover between $2.14 and $2.15 keeps the short-term ceiling well defined and the risk skewed to the downside.

Volume behavior

The rise of 177.9 million during the bounce from $2.03 confirmed strong participation, but the lack of follow-through volume during the recovery attempts indicated exhaustion. The last hour’s breakout came in at 4.4 million units in a single interval, enough to trigger an algorithmic momentum sell-off.

Trend structure

XRP now prints a clear sequence of lower highs and lower lowsconsistent with early stage continuation structures that often precede retests of major swing supports. The broader trend remains pressured by an unresolved medium-term downward slope that began after repeated failures above $2.48.

Impulse conditions

Short-term oscillators are approaching oversold readings, suggesting possible stabilization if the $2.03 level holds. But without recovering $2.15, any rebound risks becoming reactive rather than structural.

What traders should keep in mind

XRP is at an unstable turning point:

• $2.03 must be maintained to avoid a deeper fall towards the support of the next level between $1.91 and $1.73

• A recovery of $2.15 It is necessary to neutralize the bearish continuation structure

• Liquidity conditions suggest that institutions paused activity after the $2.10 failure; the renewed volume will dictate the next push.

• Bitcoin’s weak structure and death cross dynamics continue to put disproportionate pressure on altcoins

• Watch for volatility clusters around derivatives liquidation points: ~$28 million was liquidated in XRP in previous sessions and further forced selling could accelerate moves.