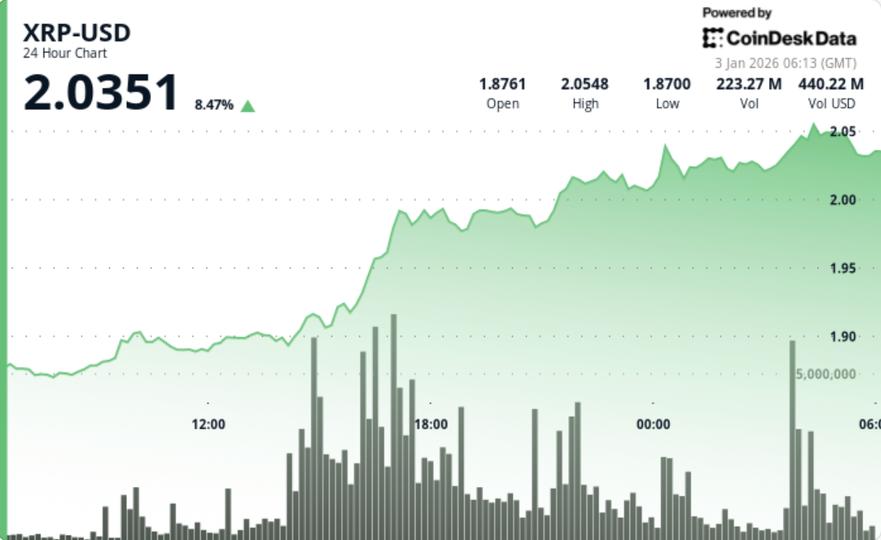

XRP rose to $2.02 after buyers forced a clean break through $1.96 on strong volume, turning a key ceiling into support and focusing on whether the token can hold above $2.00 long enough to trigger a second bullish leg.

News background

The move comes as traders re-engage with large-cap alternatives after a choppy stretch that repeatedly rejected XRP above the $2.00 level. For XRP specifically, the $1.96 level has acted as a recurring decision point in recent sessions: rallies that briefly surpassed it often struggled to hold, while failures at the level attracted rapid selling.

That makes the quality of the breakout the story this time: Instead of a mild stop-driven breakout, the rally came on sustained volume, suggesting that larger participants were active. With positioning still sensitive in early January, XRP’s ability to hold above $2.00 could influence whether sideline traders pull back or treat the move as another selling opportunity.

Technical analysis

XRP jumped 8.7% from $1.8766 to $2.0227 during the 24-hour session ending January 3, with the breakout gaining strength at 17:00 UTC, when volume increased to $154.4 million (about 142% above the session average) and the price rose decisively to $1.96.

That level is the turning point. Breaking above $1.96 turned the previous ceiling into a potential bottom, and XRP continued into the $2.00 to $2.03 band instead of immediately falling back below it. The price then established a new pocket of support near $2.01 – $2.03, which traders will treat as the “maintenance” zone if this breakout is to hold.

The late session action showed the first real test: XRP retreated from a high of $2,031 to around $2,023, attracting 1.59 million volume during the drop. Importantly, that pullback remained controlled (~0.4% retracement) and did not become a waterfall until $2.00. That’s the profile traders want to see after a breakout: digestion, not immediate rejection.

Price Action Summary

- XRP rose from $1.8766 to $2.0227 (+8.7%) in 24 hours

- The key breakout came when XRP surpassed $1.96 on a volume surge of 154.4 million.

- XRP established a new support zone between $2.01 and $2.03 above the psychological level of $2.00

- The price retreated modestly from $2.031 to $2.023, keeping the breakout structure intact.

What traders should know

This move is now about maintaining the flip, not chasing the breakout.

The levels are clear:

- If Sustained trading above recent consolidation highs would indicate that buyers are still in control.

- If XRP loses $2.00 and falls below $2.01: It becomes a “no follow through breakout” and the market is likely to retest $1.96, now the key line between a bullish reset and a return to the previous range.

- If $1.96 fails retest: The rally risks being treated as a liquidity event, reopening the decline toward the pre-breakout base.

Bottom line: $2.00 is the main level, but $1.96 is the real line in the sand. If the bulls defend both, the tape may generate a continuation move. Otherwise, this will go back to the same range that the market just escaped from.