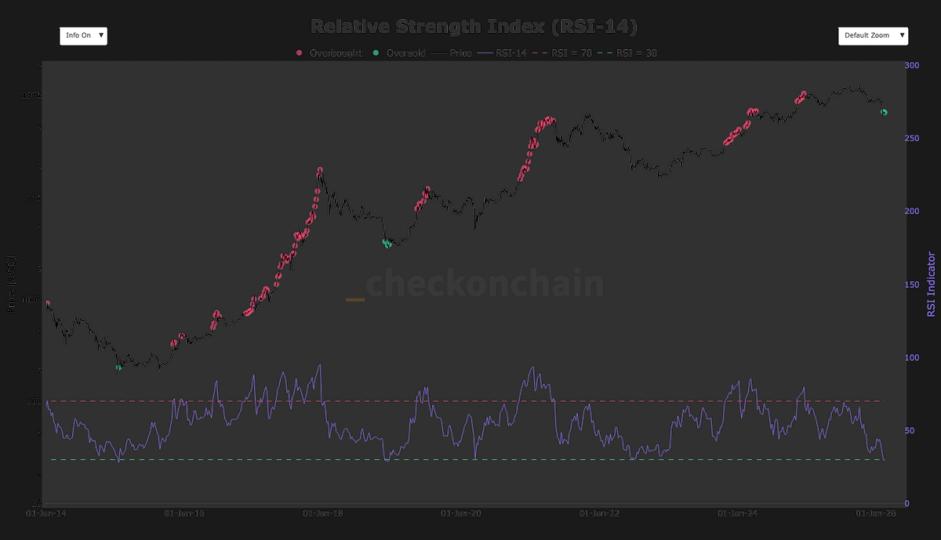

Bitcoin’s 14-day Relative Strength Index (RSI) fell below 30 for the third time in its history this month, according to checkonchain.

The RSI is a popular tool for detecting an asset’s momentum by measuring the speed and magnitude of recent price movements and comparing average gains and losses over a given 14-day period.

The index produces a reading between 0 and 100, and levels above 100 are generally considered overbought, while readings below 30 indicate oversold conditions, suggesting that selling may be overextended. Bitcoin’s 14-day RSI has not reached 100 since December 2024, when Bitcoin first surpassed $100,000.

Previous readings below 30 marked previous cycle lows. In January 2015, bitcoin’s RSI fell to around 28 while the price hovered around $200. The market then spent about eight months consolidating before a sustained recovery began. A similar pattern emerged in December 2018, when the RSI fell below 30, around $3,500. That period was followed by approximately three months of sideways accumulation before Bitcoin rose.

BTC is trading around $66,000, with sentiment stuck at “fear” or “extreme fear” on the Crypto Fear & Greed Index for much of the last 30 days. Since peaking in October, bitcoin has lost more than 50%, briefly falling towards $60,000.

History suggests that the current move could lead to consolidation around the $60,000 region in the coming months before the next leg higher.