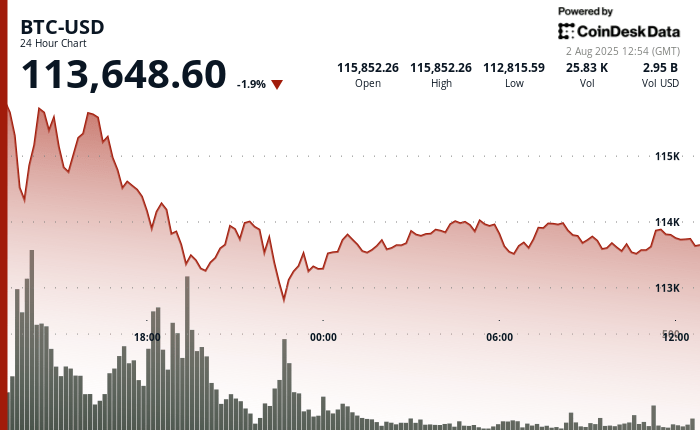

At the time of writing, according to Coendesk data, BTC was quoted at around $ 113,648, 1.4% less in the last 24 hours. ETH, XRP, Sol and Doge registered more pronounced decreases, with ETH 3.7% at $ 3,503, XRP of 1.5% to $ 2.94, Sol fell 2.7% to $ 164.13 and Doge falling 3.7% to $ 0.1993.

The recession followed a series of economic and geopolitical shocks on Friday that shook the feeling of investors in capital and digital assets markets.

The US actions also closed very less on Friday, with the Dow dropped 1.23%, the S&P 500 discount at 1.6%and the Nasdaq compound fell 2.24%as merchants digited a disappointing job report, increased tensions with Russia and the possibility of emergency monetary relaxation.

Julio Jobs’s report was a disaster, and a surprise

The United States Labor Statistics Office (BLS) Friday reported that the American economy added only 73,000 jobs in July, well below expectations. However, more worrying was a downward review of 258,000 jobs to the totals combined of May and June, effectively erasing most labor market profits previously reported for the second quarter.

The unemployment rate remained by 4.2%, but long -term unemployment increased by 179,000 to 1.8 million. The number of new participants in the labor market increased by 275,000, indicating that more Americans are looking for work but struggling to find it. The participation of the workforce remained stable at 62.2%, while the employment-population relationship was reduced by year.

Although employment growth continued in medical care and social assistance, employment in most main industries, including manufacturing, construction, financial services and technology, showed little or no change. The markets interpreted the data as a clear sign that the labor market is weakening faster than expected.

Trump accuses BLS’s electoral interference commissioner, the boss ordered

President Trump quickly and publicly responded to the job report, publishing a scathing message about Truth Social that accused the commissioner of the Erika Mtntarfer Labor Statistics Office, a person designated to Biden, to manipulate employment data in the period prior to the 2024 elections.

“This is the same labor statistics office that exaggerated the growth of employment in March 2024 in approximately 818,000 and, again, just before the presidential elections of 2024,” Trump wrote. “These were records, can anyone be so bad?”

He added: “I have ordered my team to shoot this designated politician Biden, immediately.”

The post alarmed investors, who saw rhetoric as a politicization of US statistical institutions. The elimination of a federal official responsible for economic data, based on bias claims related to elections, joined the volatility of Friday, especially for assets sensitive to rates and risk such as Crypto.

Trump’s nuclear submarine position increases Russia’s tensions

Later, on Friday, Trump saw Truth Social again, this time revealing that he had ordered that two US nuclear submarines. UU. They repositioned in response to recent comments from Dmitry Medvedev, the former Russian president and current vice president of the Russian Security Council.

“Based on the highly provocative statements of the former president of Russia … I have ordered that two nuclear submarines be positioned in the appropriate regions,” Trump wrote. “I hope this is not one of those cases” in which words lead to “involuntary consequences.”

The unexpected message, delivered without prior information or confirmation of the Pentagon, caused concern that diplomatic tensions with Moscow would have entered a new phase.

Some saw Trump’s language as a deliberate position instead of a true military threat, aimed at pressing Russian President Vladimir Putin to consider fire in Ukraine. However, even if the statement was not intended as an imminent sign of action, it still made the possibility of a nuclear confrontation of the United States Russia, even if it is unlikely, it felt more real. The merchants, who already recover from the job report on Friday morning, respond to get rid of risk assets in favor of safer bets such as treasure and effective.

The expectations of the Fed rates rate increase, but we also do the fears of recession

The on Friday’s work data took merchants to drastically increase bets in a rate reduction at the FOMC meeting of the Federal Reserve, and many now expected a reduction of 50 basic points. But the perspective of a easier monetary policy did little to reassure markets.

This is because rates cuts are no longer seen as a preventive movement to boost growth, now they look as a reaction to economic weakness that may already be developing. In this context, monetary flexibility can be interpreted as the confirmation of deterioration conditions, instead of a bullish catalyst.

For cryptographic markets, which often reflect the feeling of the technological sector, the change in the narrative weighed a lot. Despite the lowest real yield potential, the fear of an imminent recession eclipsed any short -term optimism. The result: generalized sale throughout the digital asset space and a renewed caution before the key macro events at the end of this month.