Bitcoin’s increase (BTC) after the announcement of Gamestop’s Bitcoin Tuesday treasure strategy stopped barely for the level of $ 89,000 and things are now directed decisively lower during the United States negotiation hours on Wednesday.

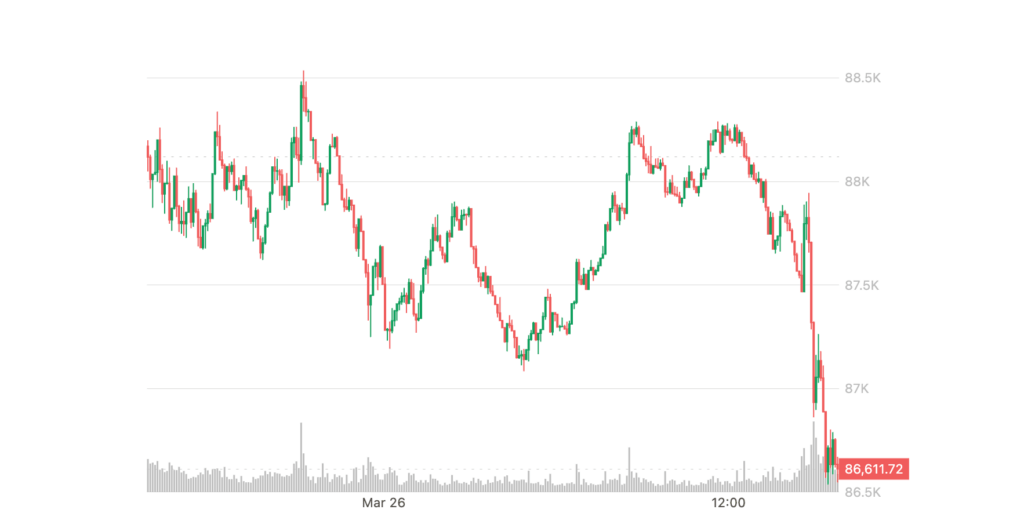

Just after noon on the east coast, Bitcoin has retired approximately 3% of maximums during the night at $ 86,500. The large market crypto reference index COINDESK 20 was 1.9% lower in the last 24 hours, with ETHER (ETH), Solana (Sun) and AAVE decreasing around 3% -4% during the same period.

The price action occurred with US risk assets. Showing weakness. The S&P500 and Nasdaq rates fell 0.8% and 1.6%, respectively, erasing most of their profits from Monday’s opening.

The new concerns about the roof of the US debt. Perhaps they are coming over the markets. The Congress Budget Office issued a warning today that the federal government can run out of money as soon as August if legislators do not increase the debt limit. American tariffs, prepared to enter into force on April 2, could also weigh the nerves of investors.

“The uncertainty surrounding the commercial policy of the United States and the broader political panorama remains frontal,” analysts of the QCP coverage fund in a telegram transmission said. “The market still lacks clarity about the scope, time and magnitude of these potential actions. Until then, we expect more lateral volatility.”

Gamestop Buy Bitcoin even bullish?

Bitcoin Bulls, meanwhile, stays once again scratching their heads, since the price does not positively react to the news of another pocket buyer that plans to invest in the largest cryptography in the world.

“Zombies companies like Gamestop ‘Tering a Saylor’ as a jail exit would worry, it would be a clear coverage sign,” said James Check, first a year ago and then Tuesday night after GME’s announcement.

He recalled that he said similar to public merchants miners when those capital combination companies decided to stack Bitcoin beyond what their mining activity provided.

“Three months ago I could not present a case where the excess sale of this cycle comes as we saw in the 2022 bears market … I suspect that in a few months, I will be able to make a case once again.”