After the US markets enjoyed a brief panting of relief on Wednesday, the lists put ugly on Thursday when the approach changed to a possible potential conflict between the United States and China.

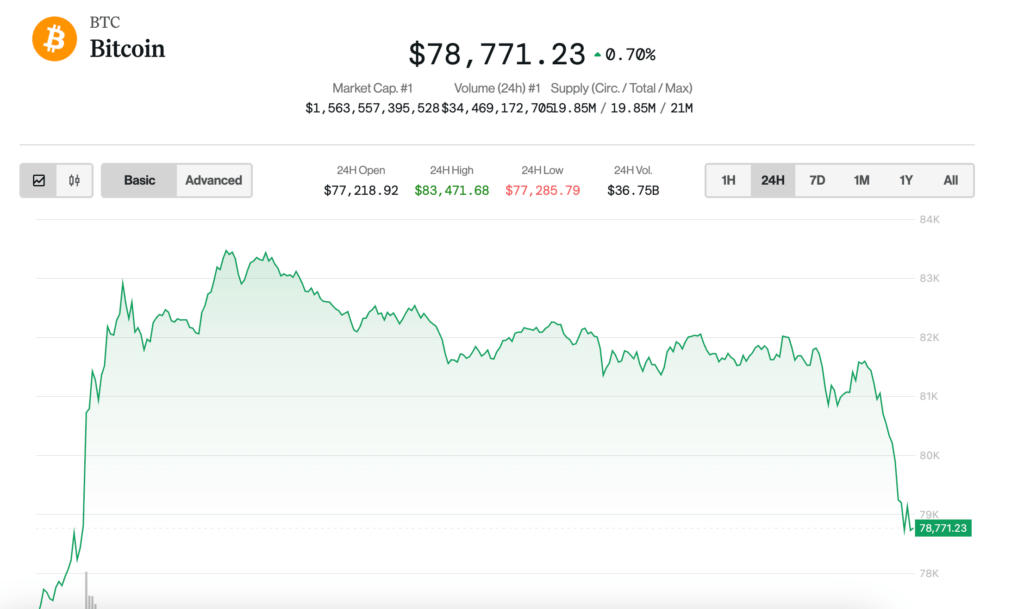

Bitcoin (BTC), which increased more than 8% the previous day, fell approximately 4% below $ 80,000 again on Thursday. The decrease in Bitcoin occurred along with a renewed drop in Nasdaq, which was lower by 5.5% after the 12% concentration yesterday, since merchants are evaluating the next steps of US President Donald Trump in his tariff policy.

Crypto’s actions also received a success. Microstrategy (MSTR) dropped 11.2%, and Coinbase (Coin) and Digital Marathon (Mara) fell 8.1%and 9.3%, respectively.

It is already very smaller in the session, the sale of shares intensified after a tweet circulated saying that a White House official confirmed that the total rate rate in China is now 145%, not 125% as President Trump declared yesterday.

The Executive Order details that the “reciprocal” rate rate increased from 84% to 125% overnight. When combined with the existing rate of 20% of fentanyl related goods, the total rate reaches 145%.

China, in an attempt to attack Trump’s initial rates, said it would reduce imports of American films, intensifying the commercial war between the two countries.

Meanwhile, gold rises 3% and reaches a new historical maximum of $ 3,168. The DXY index, which measures the US dollar against a basket of foreign currencies, has fallen below 101, effectively reversing its full November rally, and now dropped 9% from the maximum of January.

Politically loaded atmosphere

“The macro perspective is anything but sure,” said Kirill Kretov, a senior expert at Crypto Trading Automation Platform Coinpanel. “This is a politically charged atmosphere, where headlines have the power to remodel the feeling almost instantly.”

“A key swing factor is now the commercial policy,” Kretov added, with tariff policies constantly changing the Trump administration that add to concerns about inflation. “Any climbing in this front would complicate the decision making of the Fed and potentially derail the current market narrative,” he said.