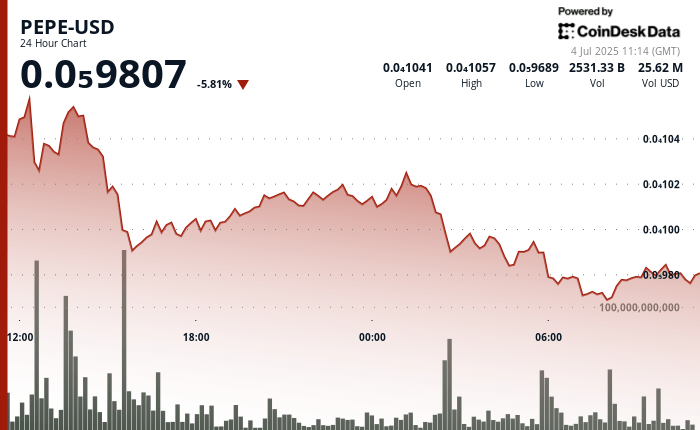

The memecoin pepe with frog theme (ENERGY) It slid almost 6% during the 24 hours, since the deadline of Trump’s reciprocal tariffs sent waves through the cryptocurrency market and exposed the volatility of the Token.

Pepe’s price became a negotiation range of 16.5%, which emphasizes how fast it can turn into an increasingly sensitive market to geopolitical and macroeconomic signals by quoting negotiation volumes.

Behind the price drop, however, large addresses seem flip. The data firm of Blockchain Nansen’s analysis show that whale wallets have increased their Pepe holdings by more than 5% in the last month, collecting tokens now valued by around $ 3 billion, more than 70% of Pepe’s supply.

Meanwhile, Pepe’s total supply in exchanges fell to a minimum of two years of approximately 247.2 billion tokens, a decrease of almost 3% since the beginning of July, according to the same source.

General description of the technical analysis

Pepe has fought to maintain profits after trying the resistance about $ 0.0000106, finding the sale pressure of the company that imposed the lowest price.

The currency found a support of around $ 0.00000965, preventing it from sliding even more, although the general negotiation range reflects persistent volatility, according to the technical analysis data model of Coindesk Research.

The graphics show a descending channel that shapes the recent price action, with sellers intervening in ascending movements. Commercial volumes reveal a distribution pattern during price peaks, insinuating that merchants are downloading positions instead of building long long.

However, the brief rebounds and the increase in purchase interest suggest that memecoin is not out of the fight. A volume explosion helped lift prices modestly from recent minimums, indicating that some merchants still see space for a rebound if it improves the broader feeling of the market.