Ether (eth)

It is quoted above $ 2,540, showing strong resistance against market turbulence fed by higher geopolitical risk. After briefly immersing $ 2,491,72, ETH recovered quickly, closing higher in the volume higher than the average and validating the key support about $ 2,500, according to the technical analysis model of Coindesk Research.

The technical indicators suggest a renewed impulse, backed by a double background formation and a large intradic purchase about $ 2,530. Eth Open Interest stood at $ 35.36 billion at 6:05 pm UTC on June 16, according to cenaging data, indicating an active institutional positioning.

However, Ethereum’s spot ETFS that lies in the United States saw $ 2.1 million in net exits on Friday, finishing a 19 -day entry streak that establishes records, according to data from Farside investors. Despite that, ETH continues to maintain its range between $ 2,500 and $ 2,800, suggesting that the upward feeling is intact for now.

Help support this narrative is a press release issued Thursday by Etherealiz, a group focused on joining institutional finances and Ethereum. The statement announced the publication of the “Bull for Eth case”, an integral report backed by ecosystem leaders such as Danny Ryan, Grant Hummer, Vivek Raman and others. The report argues that Ethereum is becoming the essential basis for a digitally native global financial system.

According to the report ‘, the global economy is experiencing a generational change, with financial assets increasingly that move in the chain. Ethereum is positioned as the primary settlement layer that allows this transformation due to its decentralization, security and activity time. Reports say Ethereum already promotes more than 80% of all tokenized assets and is the default infrastructure for stables and institutional block chain implementations.

ETH, the native asset of Ethereum, is described not only as a value warehouse but also as a programmable collateral, computational fuel and performance infrastructure. The report states that ETH has a very low price compared to its long -term usefulness and describes it as “digital oil”, a productive reserve asset that supports a componable global financial ecosystem. He argues that ETH should be a central participation in the long -term digital asset strategy of any institution, complementing Bitcoin’s role as digital gold.

In summary, although macro conditions remain volatile, the behavior of the Ethereum market, combined with continuous institutional commitment and its growing role as financial infrastructure, suggests that ETH could be forming a lasting base for a future break.

TECHNICAL ANALYSIS

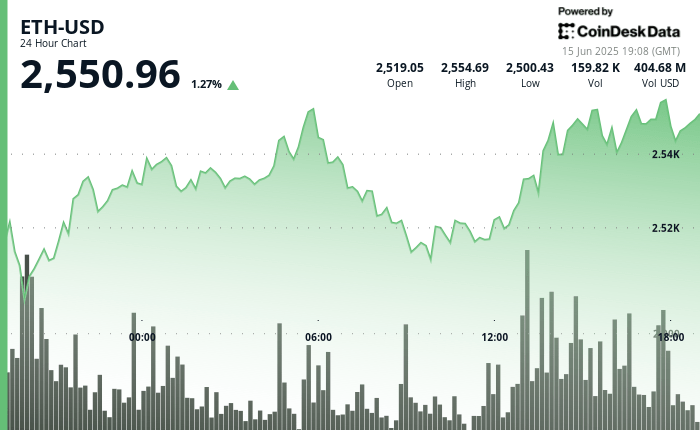

- ETH quoted between $ 2,500.43 and $ 2,554.69, closing near the session maximums at $ 2,542.

- A double bottom structure was developed about $ 2,495– $ 2,510, backed by a volume higher than average.

- The resistance was tested at $ 2,553, but a strong hour closure at 158,553 Eth Volume indicates a renewed impulse.

- A V -shaped rebound followed a minimum of $ 2,529, conducted by peaks at 13:43 and 13:46.

- The continuous purchase could push ETH to $ 2,575– $ 2,600 in the short term.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.