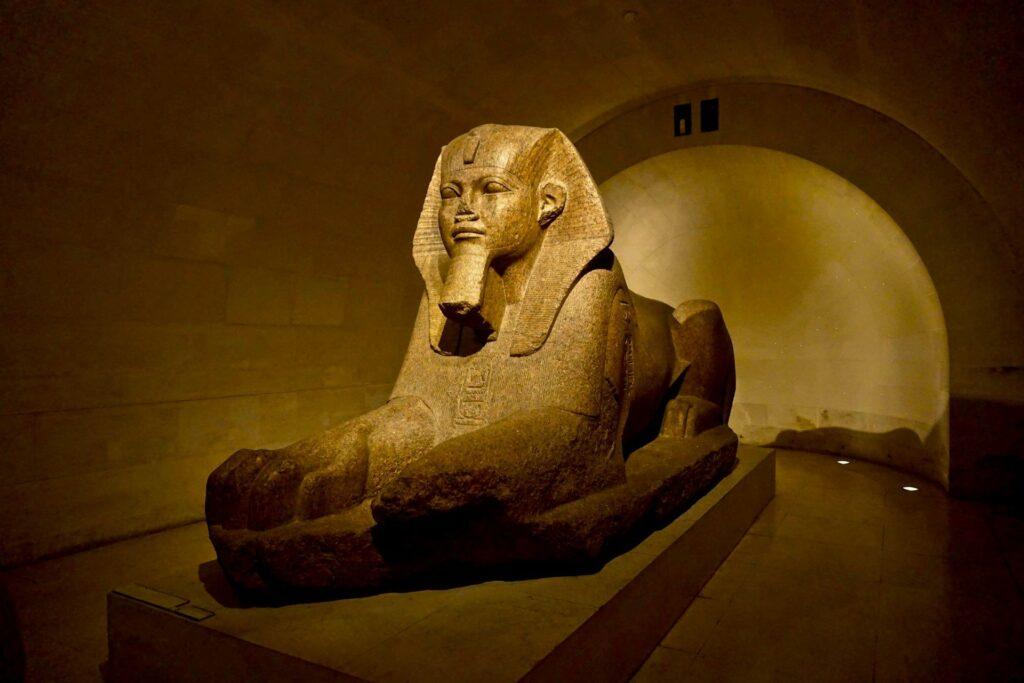

In the ancient Greek history of Oedipus, the great rewards waited for travelers capable of solving difficult riddles, but a powerful sphinx raised the riddles and devoured those who could not solve them. Similarly, in Ancient Crypto Times, around 2017, Blockchain Technology was to revolutionize finance and other fields. But two challenges interposed on the way that this technology enjoyed its maximum potential: (1) Laws of values that are not easily assigned to decentralized systems, and (2) a regulator of hostile values to digital assets, which often raised serious risks for those who tried to solve the first challenge.

Today, the Sphinx has resolved to be more useful, but the riddles remain. The cryptographic work group of the stock exchange and values commission (“SEC”) has stated that the agency’s previous regime created “an environment hostile to innovation” and has pledged to work with industry participants to create sensitive regulations. While it is promising, there are significant challenges. American values laws are a combination of statutes approved by Congress and the rules adopted by the SEC. The working group has indicated the SEC willingness to make the latter more viable through new rules and exemptions. However, the statutes present most of the challenges and only Congress, not the SEC, can change them.

Below is a manual in the most common riddles facing tokenized values developers.

Regulatory considerations

For tokenized values, the developer creates tokens in the chain that represent a proportion of capital in one company or other security, or another asset that offers the right to cash flows. This tokenization can open possibilities, such as instant settlement, fractionalization of sharing and daily dividend payments, which make the product more efficient or functionally diverse than its traditional counterpart.

Although sec can be more receptive to ideas for tokenized values, it does not have the authority to change the statutes. The tokenized securities projects, therefore, must resolve or avoid the riddles that these statutes present.

The investment company’s law

If a Token grants to its owner the economic exhibition to the assets that the developer has grouped, that Token project could be an investment company covered by the law of the investment company, which regulates companies, such as mutual funds, which invest in values and allow investors to obtain exposure to those investments through actions they issue.

This riddle existed long before cryptography, and most chose to navigate to avoid being classified as an investment company in the first place. This is because the requirements imposed by the investment company law do not work well with the business models that imply more than the purchase and sale of values. There are substantial restrictions in debt and capital increases, loans and even affiliate businesses. For those who cannot avoid activating these requirements, there are exemptions that may be available.

Bag runners under the securities exchange law

Anyone who bought and sells values for others or is ready to buy and sell values for their own account can be a corridor or distributor. There is no brilliant line for rating as a stockbroker, but the SEC and the courts consider that it indicates whether it provides liquidity, charges a rate related to the commercial price, actively find investors or play a role in maintaining funds or securities of the customers.

While there is no practical way of exchanging digital assets such as a stockbroker currently, the SEC could use its existing authority to draw a realistic path to do so. In the best case, that will take time and continue with some compliance obligations.

Exchanges under the Securities Exchange Law

While it is possible that it is not seen as a traditional exchange of values, a platform that uses intelligent contracts to replace orders of tokenized values of multiple buyers and multiple sellers for coincidence and execution could qualify as one, depending on its structure.

Currently, only stockbrokers can trade with exchanges, and exchanges cannot have customer accounts or custody customer values. Even if the SEC can rework these rules, some requirements would undoubtedly persist.

Safety -based swaps under the securities exchange law

If a tokenized security gives its owner the exposure to economic performance of one or more values, the complicated world -based swaps world may have crossed. In general, files that provide the exchange of future payments based on the value of security (or events related to that security) without It is likely that the transmission of property rights is swaps. Security -based swaps are under the joint jurisdiction of the SEC and the Basic Products Trade Commerce Commission. The requirements for them are many, being the most notable rules that prohibit retail investors buying swaps.

AML and KYC

The companies involved in trade or the transfer of tokenized values must also consider the applicability of laws against money laundering and knowledge. The compliance requirements depend on the paper that is played in transactions, but may include collecting and verifying the name, date of birth and customer address.

Riddles must be worked, not around

Solving these riddles is not an end in itself. When designing any tokenized values project, developers make decisions based on economics, technology and regulatory framework. These areas are intertwined, since technology can make the economy possible and decide where a project falls within the regulatory framework. But because these considerations are so interrelated, developers should analyze them in an integral way from the beginning. Leaving regulatory considerations for the end can become a Jenga game where problematic parts are eliminated only to defeat the benefits and objectives for the economy and technology. The riddles raised today are not simply obstacles to the many advantages of blockchain technology, but crucial parts of the response.

The opinions expressed in this article are those of the authors and do not necessarily reflect Skadden’s opinions or its clients.