Stellar’s

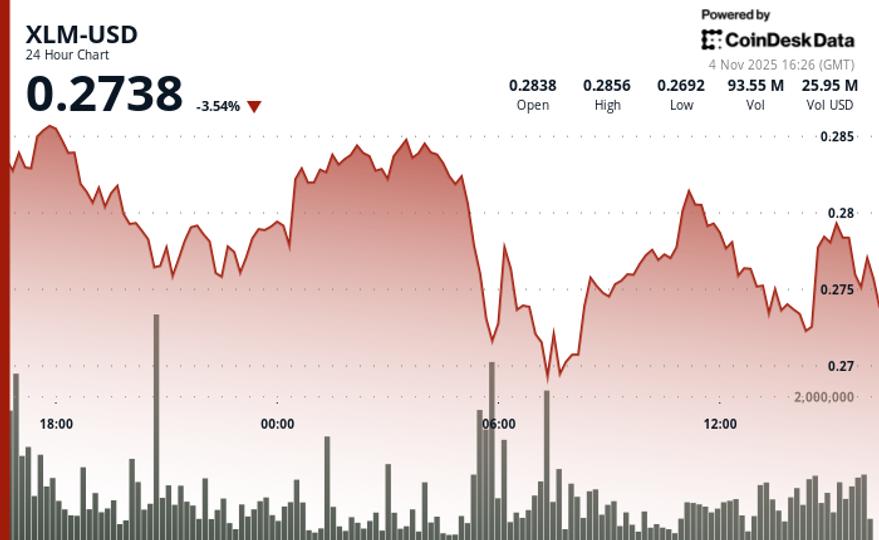

The cryptocurrency spent the session forming lower highs and lower lows within a trading range of $0.0227, as sustained selling pressure dominated market sentiment.

The most significant move came on November 3, when XLM broke below its crucial support level of $0.2800.

The crash caused a surge in trading activity, with volume rising 483% above the 24-hour average to 262.9 million tokens. Heavy selling continued into the following session, marking $0.2857 as firm resistance after multiple failed recovery attempts.

On November 4, new short-term support had emerged near $0.2720, although buyers struggled to defend it. The price briefly recovered to $0.2740 before faltering again due to low momentum and reduced volume – only 638,000 tokens were traded during the attempted bounce.

With no clear fundamental catalysts in play, XLM stock remains technically driven. The inability to hold above $0.2740 indicates continued weakness, and traders now consider the $0.2700 psychological level as the next potential downside target.

Key technical levels indicate bearish continuation for XLM

Support/resistance analysis

- Immediate resistance at $0.2857, confirmed by multiple failed tests showing seller dominance.

- The break of key support at $0.2800 triggered accelerated selling on November 3rd.

- The current support zone between $0.2720 and $0.2740 is showing signs of weakness.

- The next downside target is at the psychological level of $0.2700.

Volume analysis

- Volume increase of 483% above the 24-hour SMA during the breakout.

- The peak volume of 262.9 million tokens occurred during the failure of the $0.2800 support.

- The recent rebound attempt showed decreasing volume (638K), indicating weak buying interest.

Chart Patterns

- Downtrend established with lower highs and lower lows.

- The failed bounce from the lows of $0.2722 confirms the current bearish momentum.

- The trading range of $0.0227 highlights elevated volatility and persistent selling pressure.

Risk/reward assessment

- The bearish bias remains intact as the price remains below $0.2800.

- Short-term traders are targeting a move lower to $0.2700.

- The recovery scenario calls for a recovery of the $0.2740 support with volume confirmation.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.