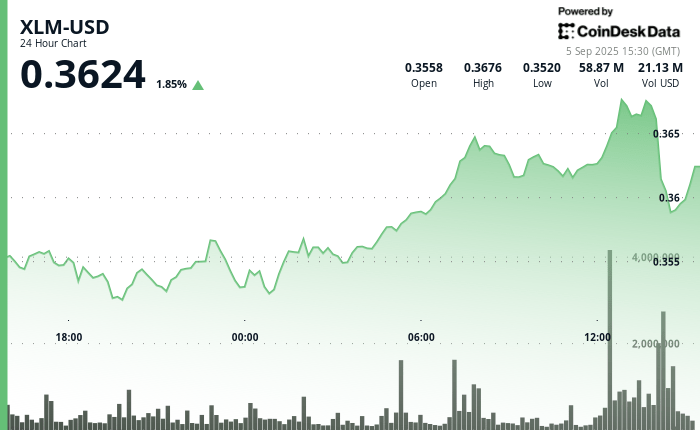

Stellar’s Token XLM demonstrated an impressive resilience in the last 24 hours, rising from $ 0.36 to a session peak of $ 0.37 before they turn again to finish at $ 0.36. The movement represented an intradic range of 5%, underlined by a great commercial activity that pointed to a greater market share. In particular, the asset found a solid base at $ 0.35 during the afternoon session of September 4, with a purchase impulse confirmed by volumes greater than 16.9 million tokens.

The rupture above $ 0.36 of resistance reached the increasing activity, with volumes that increased to 28.03 million at 07:00 and an amazing 82.75 million at noon on September 5. This demand influx promoted XLM to its daily maximum of $ 0.37, marking a decisive trial of bullish force. However, a strong investment in the final negotiation time eliminated those profits, since the sellers brought the price to the level of $ 0.36.

Despite the retreat of the late session, XLM closed the 1% period above its opening value, maintaining a widely bullish technical structure. The movement conforms to a broader trend: Stellar has published a surprising gain of 288% during the past year, which attracts institutional interest such as protocol 23 updates and cross -border payment solutions reinforce its long -term foundations.

That said, the competitive panorama is still intense. With the increase in PayFI platforms challenging Stellar’s market position, XLM faces increasing external pressures, even when the volumes suggest a solid participation of the merchant. For now, the combination of robust support levels and high demand provides a constructive backdrop, although volatility is likely to remain a defining characteristic of short -term pricing action.

Technical indicators show mixed signals

- Solid Support Foundation confirmed at $ 0.35 with a substantial volume support during the period of September 4, 20:00.

- The main ascending intervals materialize during the intervals of September 5, 07:00 and 12:00 with an exceptional volume expansion.

- Resistance penetration at $ 0.36 accelerated XLM to the session peak of $ 0.37.

- The reversal of the severe final hour began an intensive sales wave with an exceptional volume participation.

- The fundamental upward frame maintains integrity despite the pronounced setback of the closing session.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.