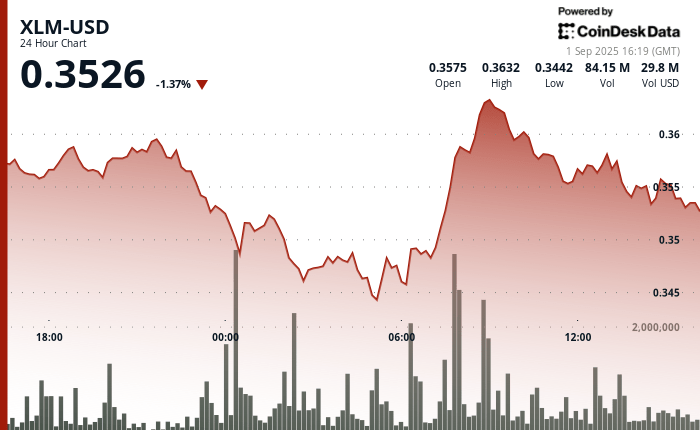

Stellar’s Token XLM suffered a strong sale pressure in the last 24 hours, quoting 5% tight but punishing between $ 0.34 and $ 0.36. The session began with relative stability before a sale of a flood sale eliminated the token of its peak of $ 0.36 to $ 0.34.

The negotiation volume increased more than 57 million units at midnight, since the market tested support around the $ 0.34– $ 0.35 area. The buyers returned early the next morning, briefly lifting XLM at $ 0.36 in the back of what seemed to be the institutional accumulation, with volumes that swell to 70 million units.

Despite the recovery, the price action stagnated in around $ 0.36, creating a scope structure that technical merchants say that it often precedes a directional breakup. The last time of negotiation on September 1 showed control at the time of recovery of bearish impulse, with XLM sliding 1% as the consolidation pattern broke.

Intradia data highlighted an acceleration of the sales pressure between 13:45 and 13:46, when more than 1.28 million tokens changed hands to the minimum of the day. The recovery attempts failed before closing, and the lack of activity in the last minute suggested that trade had effectively stopped.

The foundations of Token were also tested by developments related to exchange and network. Bithumb of South Korea announced that it will suspend the XLM deposits on September 3, while Stellar implements network updates, a temporary interruption that underlines the transition from the block chain in a critical update phase this month.

At the same time, the completion of Ripple pilot tests with banks has reinforced a broader confidence in blockchain -based payment solutions, exerting additional pressure on stellar to offer competitive improvements.

SPIKES VOLUME SIGNAL INSTITUTIONAL ACTIVITY

- The negotiation range of $ 0.02 represents a 5% differential between the $ 0.34 support and the $ 0.36 resistance during the session.

- Midnight Selloff generates 57 million volume of volume that indicates a large institutional sale.

- The overtension of the morning recovery reaches $ 0.36 in 70 million volume, which suggests the accumulation phase.

- Confirmed resistance at $ 0.36 with a support area established around $ 0.34- $ 0.35.

- Attempts to recover the final hour fail when the bassist impulse accelerates.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.