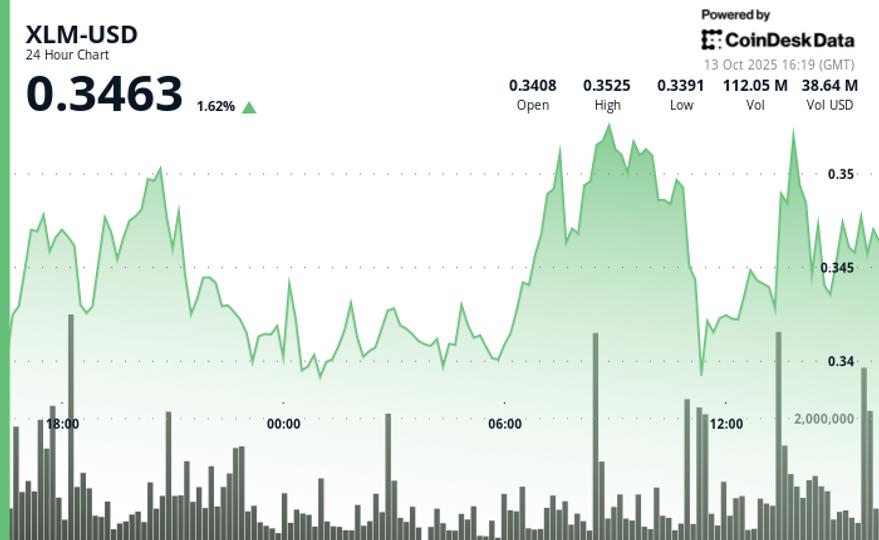

Market Recovery: XLM Leads with 6% Daily Gain

Stellar’s XLM rose 6% in the last 24 hours, closing at $0.35 after weathering bouts of volatility. The asset traded within a range of $0.02 between $0.33 and $0.35, briefly falling to $0.34 before buyers regained control. The recovery underlines the growing bullish sentiment in major crypto assets following the October sell-off.

Institutional buying signals

The last hour of trading showed strong institutional buildup. XLM opened at $0.35 before falling to $0.34 at 1:29 p.m. In a strong three-minute rally from 1:31 p.m. to 1:33 p.m., bulls pushed prices back to $0.35 with an increase of 15 million tokens traded, a move that technical analysts interpreted as a hallmark of institutional participation.

Technical image and macro context

XLM’s performance reflects broader crypto resilience despite persistent macroeconomic headwinds. Analysts point out that wave 4 support remains firm, validating a bullish continuation pattern. Veteran trader Peter Brandt reiterated confidence in major digital assets, calling the recent market weakness a “temporary shakeup” within an intact uptrend.

Perspective

Resistance remains at $0.35, where selling pressure continues to emerge, while support has solidified near the same level, suggesting a spiral setup. With hourly gains of 1% at the close of the session and volume-backed accumulation, XLM appears poised to extend its recovery momentum in the near term.

Summary of technical indicators

- The key support zone emerges between $0.34 and $0.34, where buyers are constantly intervening.

- Resistance builds up at the $0.35-$0.35 level where selling pressure intensifies.

- Volume patterns show institutional participation at critical inflection points; the 24-hour average of 37.5 million sets a benchmark.

- Strong resistance remains at $0.35, where sellers steadily emerge in the final session.

- Support consolidates near $0.35, creating a tight range in the final 30-minute window.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk’s full AI policy.