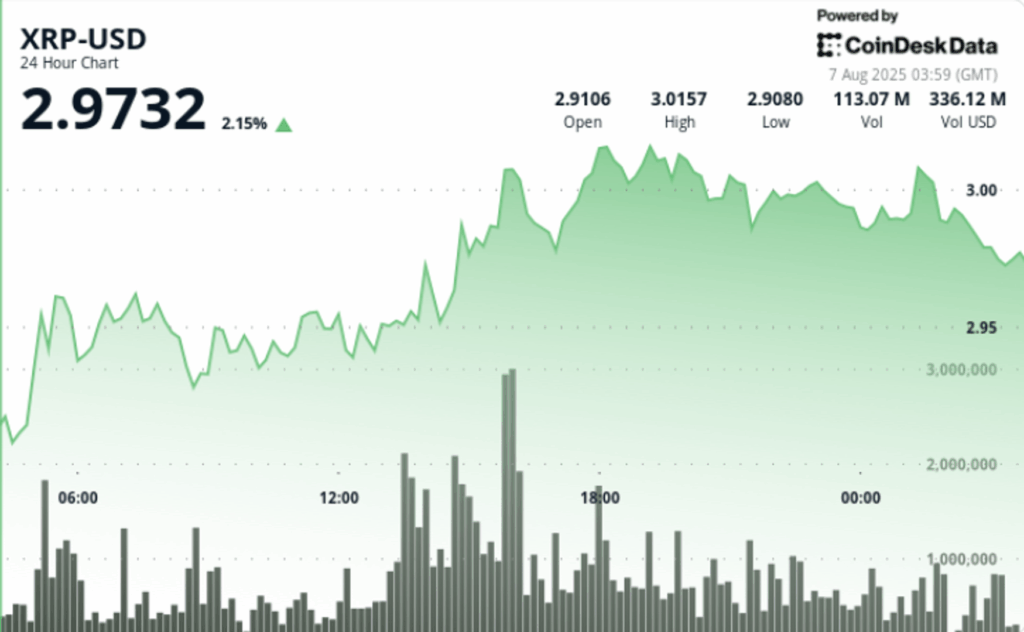

XRP increased 3% in 24 hours until August 7, moving from $ 2.91 to up to $ 3.02 before closing to $ 2.98.

The movement broke through multiple levels of short -term resistance and coincided with a high -volume purchase activity, particularly in Korean exchanges.

The technical impulse is aligned with the key macro developments: the US stock and values commission will deliberate about Ripple’s appeal retirement, while Japan SBI holdings have requested an ETF Bitcoin-XRP.

News history

The SEC is expected to deliberate Ripple’s decision to withdraw its appeal at 03:00 UTC on August 7, before a broader failure that is expected in the middle of the month. The audience could block the non -security status of XRP under US law, a result that eliminates a long -standing regulatory cantilever.

Meanwhile, the ETF application of SBI Holdings highlights international institutional interest, with the efforts of diversification of the Treasury that gain impulse of companies that promise up to $ 1 billion in XRP purchases.

Summary of the price action

- XRP negotiated in a 24 -hour range between $ 2.91 and $ 3.02, a 3.7%band.

- The strongest ascending movement occurred between 15:00 and 16:00 UTC as the Token increased from $ 2.95 to $ 3.02, driven by buying volumes above 110 million tokens, or three times the daily average.

- Most of this flow originated from UPBIT, which processed more than $ 95 million in XRP operations. The asset then consolidated between $ 2.98 and $ 3.00 at the close of the session.

Technical analysis

- XRP broke resistances at $ 2.87, $ 2.92 and $ 2.97 during the rally. The last hour showed a failed attempt to violate $ 3.02, with an investment back to $ 2.98 as a volume increased to 2.11 million in a 10 -minute window.

- The $ 2.98 level now acts as a short -term support. If the Bulls defend this area, the upward objectives remain at $ 3.05 and $ 3.14, with $ 3.25 in view of the approval of the ETF or the comments of the SEC become favorable.

What merchants are seeing

- The UTC session of 03:00 of the SEC and if the Ripple Appeal Retirement is formalized

- SBI ETF presentation and potential entries

- Price reaction to $ 3.0 if XRP re -tests local maximums in volume trends of UPBIT and Binance as indigentes of retail and institutional participation

- Any short -term regulatory comments before August 15 Review of the Legal State of XRP