The Ripple XRP recorded a 5% gain of the day when the merchants shrunk from a new opposition wave of traditional banks to the Ripple license application.

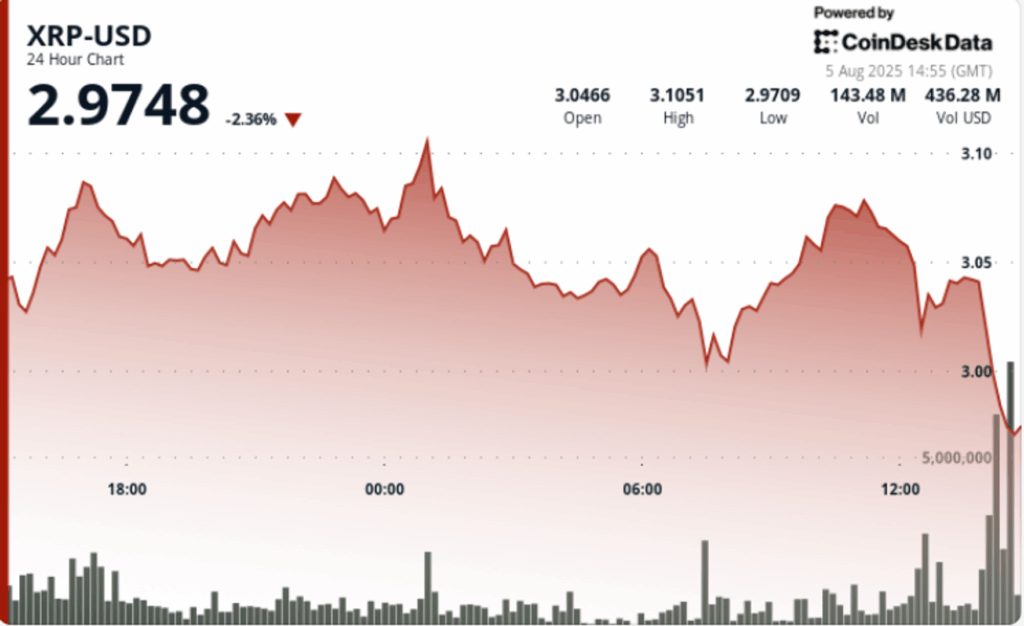

The price action remained volatile between $ 2.83 and $ 3.11, with a short -term rise in the resistance levels, while the volumes increased more than 110 million XRP, including a transaction of a minute of $ 33 million that scared the request books.

What to know

- BPI, which represents 42 banks, presented objections to the Banking license pending Ripple, injecting a new uncertainty into the regulatory deadlines.

- XRP recovered from $ 2.83 to $ 3.11 before closing at $ 3.04, with an intra -dialing swing of 9.8% in the session.

- Support for $ 3.00 maintained despite half -day departures and an impulse of fading above $ 3.09.

- Institutional flows remained neutral in the network: $ 2.1 billion in the disinversion of compensated tokens at $ 14 million in leverage long positions.

- The models promoted by the IA project a movement of $ 3.12 for the end of August, although the sequential TD indicates a short -term investment risk.

News history

The coordinated presentation of the banking sector against the Ripple license effort marks the most concentrated resistance that the company has faced since its partial victory against the SEC. For merchants, the news was mainly background noise, since the price of XRP remained firm above $ 3.00 and saw liquidity explosions typically associated with great players who entered and left the asset.

Summary of the price action

- COINDESK ANALYTICS shows that XRP reached a maximum of a $ 3.11 session around 5:00 p.m. before reverting on volume peaks of 69.89 million XRP.

- The support was formed to $ 2.97 during the Asia session (05: 00–06: 00), reinforced by consecutive 50m+ XRP operations.

- The action of the final hour (13: 09–14: 08) showed that XRP remained at $ 3.03, with 2.1 million XRP sold during the attempt to break down.

Technical analysis

- The price structure shows a clean consolidation band between $ 3.00 and $ 3.02, without still structural breakdown.

- The bulls failed several times at $ 3.09– $ 3.11, indicating short -term exhaustion near that resistance group.

- The negotiation volume remained above the daily average (47.7 million) in five separated hours, showing a sustained interest.

- Sequential TD in the 3 -day chart indicates a complete count of 9, typically a local top.

- The rupture level remains $ 3.05, with upward extensions at $ 3.15 possible if the volume returns above 50m/hour.

What merchants are seeing

- If Ripple responds publicly to the challenge of the banking sector and how regulators react.

- If $ 3.00– $ 3.02 continues to act as an accumulation range for larger headlines.

- Volume participation in the weekend: Any deceleration could be established for a new test of $ 2.92– $ 2.97.

- Trend Whips in confirmation above $ 3.05 in a volume per strong hour, aimed at a range of $ 3.12– $ 3.25.