While Bitcoin (BTC) slipped only modestly, other important cryptocurrencies fell in recent days, which caused doubts of the durability of the so -called Altcoins season.

XRP (XRP), Dogecoin (Doge) and Solana’s Sol (Sun) decreased the majority among the 10 main crypts on Friday, sliding around 5% each of the last 24 hours, as shown by Coindesk’s data. From the maximum of Wednesday, XRP and Dege fell around 18%, while Sol dropped 12% in the same section. The Coendesk 80 index, which consists of medium capitalization tokens outside the Coendesk 20, lost 10% of the weekly peak.

Meanwhile, BTC was changing hands around $ 116,000, a little more than 3% lower since its peak in the mid -120,000 week. Ethereum’s Ether (ETH) was 4% below its weekly maximum, backed by the constant accumulation of cryptographic treasure strategy companies.

When the Altcoin season?

The strong liquidation of the last days occurred after weeks of heavy capital rotation in smaller sheets, feeding the conversations of a full -fledged Altcoin season. That period, sometimes called the alternative season, occurs when smaller and smaller tokens exceed Bitcoin, the leading cryptography, for a sustained period.

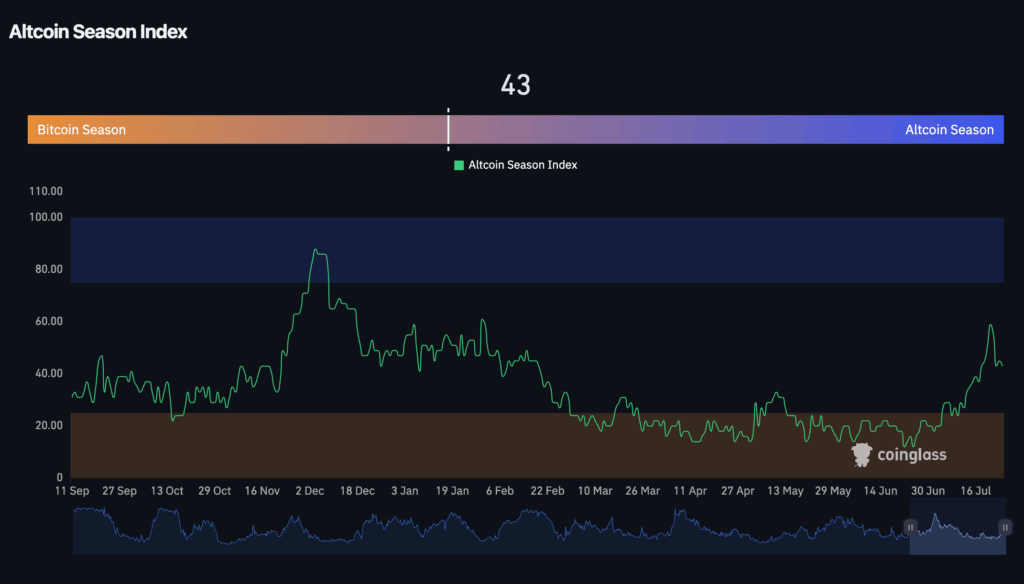

The Coinglass alcohol season index, which measures the upper performance of the Altcoin BTC market on a scale of 0 to 100, cooled to 41 on Friday from 59 on Monday, the strongest reading from the speculative frenzy at the end of January around the inauguration of President Trump.

Even so, the total market of Altcoin (except Stablecoins) saw a rapid appreciation, almost doubling its value since April, said David Duong, head of research in Coinbase, in a Friday report.

For this week’s recoil, the merchants who assumed the excessive leverage of the Altcoin bets were guilty, the report said.

The Altcoin Open Interest Domain Metric, which compares the amount of dollars tied in Altcoin derivative contracts with those of Bitcoin, rose to 1.6, a level that has preceded the previous market shakes, said the report. A decrease in the relationship would suggest a restart of healthy leverage for the Altcoins market, otherwise more shaking is expected, Duong wrote.

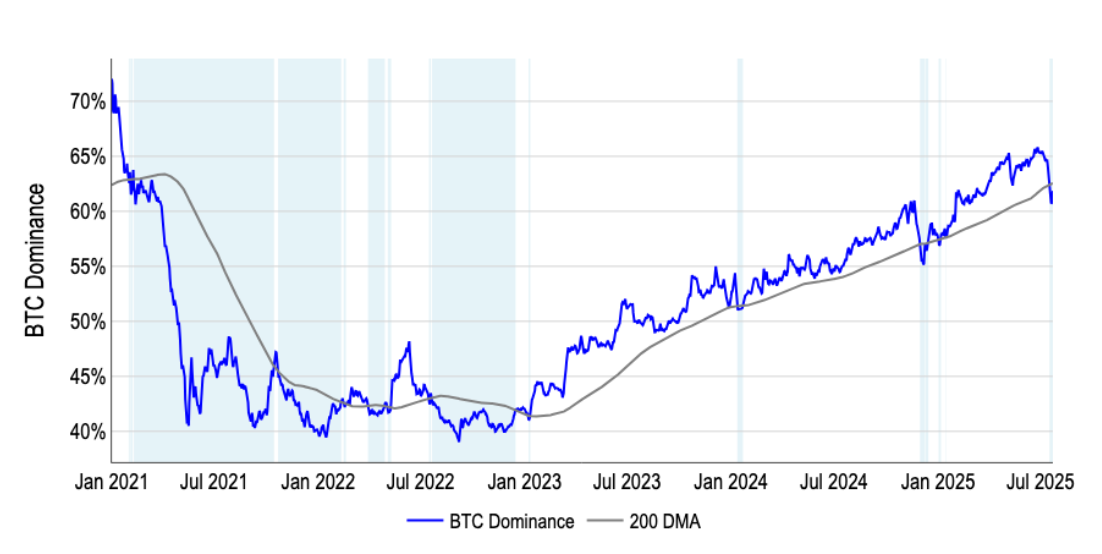

For an extended Altcoin season, investors must monitor the Bitcoin domain, which measures the participation of BTC of the total capitalization of the market crypto. The metric has been broken below the 200 -day mobile average for the first time since a short period in January 2025, the report said.

“A sustained movement under 200-DMA could validate the narrative of the ‘alternative season’ and has historically preceded sections of multiple weeks of superior performance (as in 2021),” Duong wrote.

However, merchants could be better waiting for more consecutive sessions to be closed below the level before accumulating alternative bets due to a “more prudent positioning,” he added.