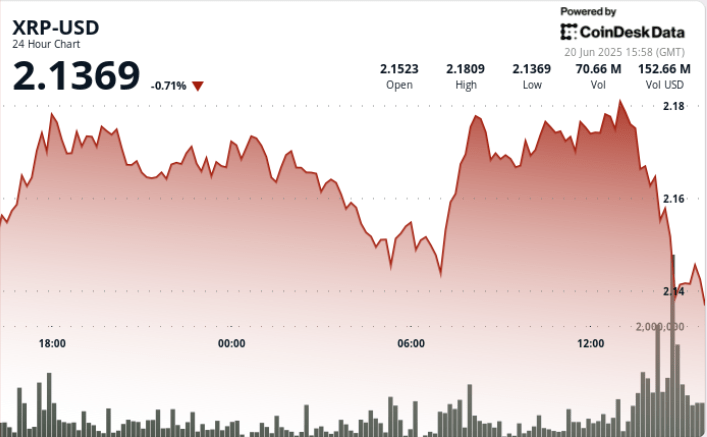

XRP stabilizes near the top of its recent range and shows signs of bullish pressure as the volatility narrows.

With a strong support backed by volume at $ 2.14– $ 2.15 and multiple resistance tests to $ 2.18, the asset seems to be rolled inside an ascending channel, configuring the scenario for a possible rupture.

News history

- The conflicts of the Middle East triggered a feeling of renewed risk in all markets, generating liquidations through cryptography. While the main assets such as Cardano and Solana registered more than 1% decrease, XRP has managed to maintain land, forming higher minimums and carving a new negotiation band in the $ 2.14– $ 2.18 area.

- This resilience occurs when the Federal Reserve prepares to announce its next interest rate decision. With the increasingly fragmented global economic policy, cryptography merchants are preparing for acute movements in digital assets.

- Despite the broader caution, XRP’s recent behavior suggests an underlying resistance, with a technical compression pointing to a possible breakup configuration.

- XRP’s long -term structure remains in focus. After almost 200 days of varying between $ 1.90 and $ 2.90, the Token is testing the upper end of a descending channel in the USDT pair, with macro resistance about $ 2.60.

- Analysts continue to discuss whether this structure reflects the 2017 XRP price configuration, a consolidation that preceded a break of 1,300%.

- Meanwhile, investors’ behavior is changing. Glassnode data show a growing activity of obtaining profits with an average of $ 68.8 million per day, even when Bollinger bands narrow, a classic sign of pending volatility.

Price action

XRP quoted within a range of 3.81% of $ 2,143 to $ 2,182 in 24 hours, with a strong purchase pressure defense support at $ 2,143 during the 07:00 hours, where the volume increased to almost 50 million units. The resistance was repeatedly tested to $ 2,179– $ 2,182 throughout the day, but remained firm.

In the final negotiation time, XRP fell from a local maximum of $ 2,181 to $ 2,167, a 0.7% drop that formed a new short -term descending channel. The volume increased to 1.7 million as the $ 2,170 support was violated, but the price was quickly stabilized and formed a higher low, preserving the broader bullish trend structure.

Technical Analysis Summary

- XRP recorded a range of 3.81% 24 hours, from $ 2,143 to $ 2,182.

- The support remained at $ 2,143– $ 2,147 with a heavy volume during the first minimums of the session.

- Proven resistance at $ 2,179– $ 2,182 several times, forming a clear upper limit.

- The price action seems to form an ascending channel with minimums higher intact.

- The mass sale for the late session activated by an increase in volume of 1.7ma $ 2,170, but the price was recovered to $ 2,167.

- Descending micro-channel formed in the last hour; The broader trend remains optimistic if the support of $ 2.14 is maintained.

- Bollinger bands hardening; RSI neutral to 52 suggests pending volatility.