What to know

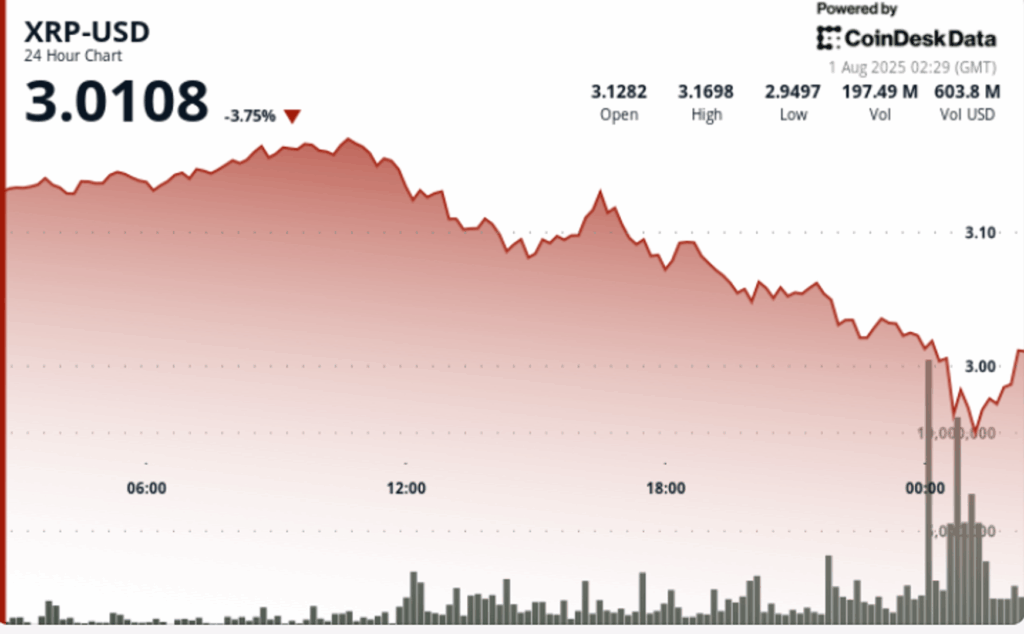

XRP decreased 8% in the last 24 hours, falling from a maximum session of $ 3.17 to a minimum of $ 2.94, since the intense sales pressure overwhelmed the initial force. The most acute fall occurred during the midnight negotiation window on August 1, when XRP fell 2.7% in a single hour, accompanied by 259.21 million units in volume, almost 4 times its average of 24 hours.

Despite the bearish trend, the signs of accumulation arose during the recovery phase, since XRP recovered to $ 2.98. The volume decreased after the initial volatility, which suggests that institutional buyers intervened to absorb excess supply near the key support areas.

News history

The whale activity that surrounds XRP continues to deliver mixed signals. On the one hand, large spokesman have liquidated approximately $ 28 million in XRP Daily For a 90 -day period, according to data in the chain. This trend highlights the persistent distribution among institutional and early holders.

At the same time, finished 310 million tokens XRP have accumulated, valued at almost $ 1 billion, During the recent correction phase, as exchange balances fell sharply, pointing out the entry of sustained capital.

In addition to the crossed currents, Maxwell Stein, director of digital assets at Blackrock, confirmed the participation in Ripple’s Swell 2025 Conferencehinting at a growing institutional alignment despite the recent prices pressure.

Summary of the price action

• High: $ 3.17 (10:00 UTC, July 31)

• Low: $ 2.94 (00:00 UTC, August 1)

• 24h change: -8%

• Low point per hour: $ 3.02 → $ 2.94 (midnight fall)

• Volume arises: 259.21m units during correction against 64.89m average

• Closing price: $ 2.98 (marginal recovery at the close of the session)

The XRP closing price about $ 2.98 represents a lower recovery of the minimums of the session, but still points out a broader structural weakness. The short -term feeling is still fragile in the midst of liquidation flows and technical breakdown below the threshold of $ 3.00.

Technical analysis

The $ 2.94 support zone remained firm during multiple intradicate tests, reinforced by the aggressive purchase of immersion that allowed prices to recover $ 2.98 at the end of the session. The resistance remains above $ 3.02– $ 3.05, with a continuous rejection probably unless the stains tickets are recovered.

Impulse indicators remain bass player, although recovery volume profiles suggest some exhaustion in mass sale.

What merchants are seeing

• If $ 2.94– $ 2.95 is maintained as a structural support in the short term

• Signs of accumulation of renewed whales or a pause in distribution trends

• Blackrock’s positioning before Ripple Swell 2025 and its implications for future XRP ETF -related ETFs

• Reaction in the $ 3.00 resistance band – $ 3.05, which previously marked the key distribution levels