XRP increased to new maximums after the Japan SBI announced an institutional loan initiative, lighting volumes greater than 160 my increase the price through the key resistance. The buyers defended $ 2.93 several times when the flows were consolidated, with the ETF decision window of October 18 now framing the next break -up test towards $ 3.00.

News history

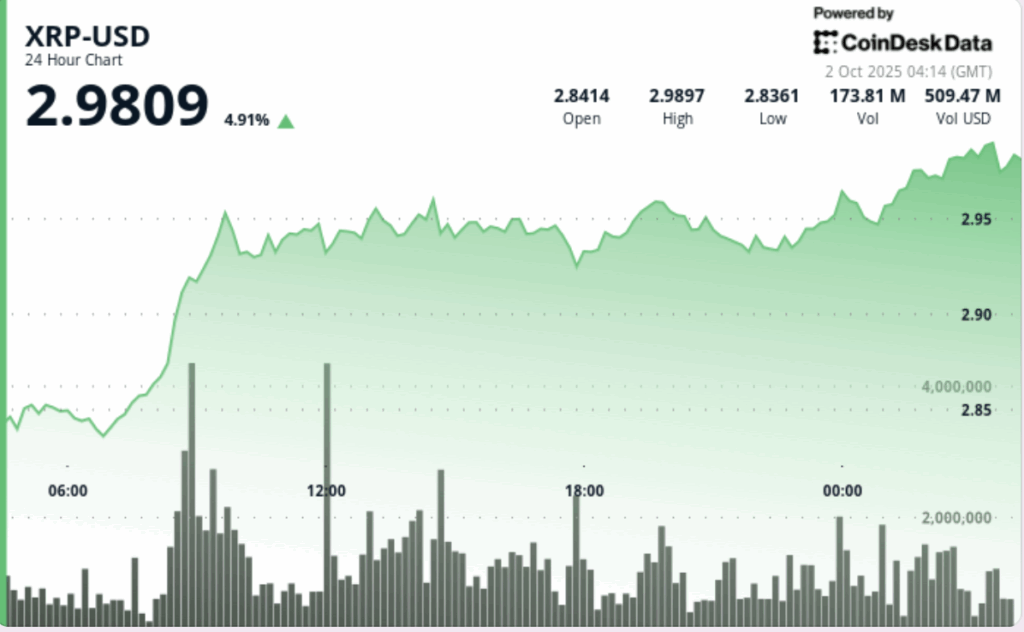

XRP rose 5.2% on the 24 -hour window from October 1, 03:00 to October 2, 02:00, moving from $ 2.84 to $ 2.97. The measure followed the SBI launch of an XRP loan program for institutional payments, highlighting Japan’s impulse in large -scale adoption. The rally also occurs when Ripple David Schwartz’s CTO makes transitions to an emeritus paper and with seven ETF spot presentations waiting for decisions of the SEC from October 18.

Summary of the price action

The Token quoted a band of $ 0.16 (5.6% volatility) between $ 2.82 and $ 2.98. The rupture accelerated at 08:00 on October 1, since XRP started from $ 2.86 to $ 2.92 in 164.5m tokens, more than double the daily average. The subsequent consolidation maintained a support of $ 2.93 through multiple reestimations, while the resistance referred to $ 2.96– $ 2.98. In the last hour, XRP extended 0.28% of $ 2.96 to $ 2.97, reaching $ 2.98 before sellers limit the advance.

Technical analysis

The support has changed to $ 2.93 after repeated defenses, while the resistance remains rooted at $ 2.96– $ 2.98. The rupture was validated by volume spikes, including an explosion of 4.8 m during the latest session rally, indicating the institutional demand that supports the measure. The hours chart showed an ascending structure of the textbook, with minimums higher than $ 2.96– $ 2.97 that leads to the session peak. Bulls need a decisive closure above $ 2.98 to confirm the impulse towards the psychological barrier of $ 3.00.

What operators are seeing?

- If XRP can keep closed above $ 2.96– $ 2.98 to establish a break of $ 3.00.

- Impact of the SBI loan program on Asian liquidity flows and if buying persists in US hours.

- The positioning changes ahead of the deadline of October 18 for seven Spot ETF applications.

- Wider confirmation of the CD20 index, since the even tokens were also recovered from 4 to 5% with high volume.