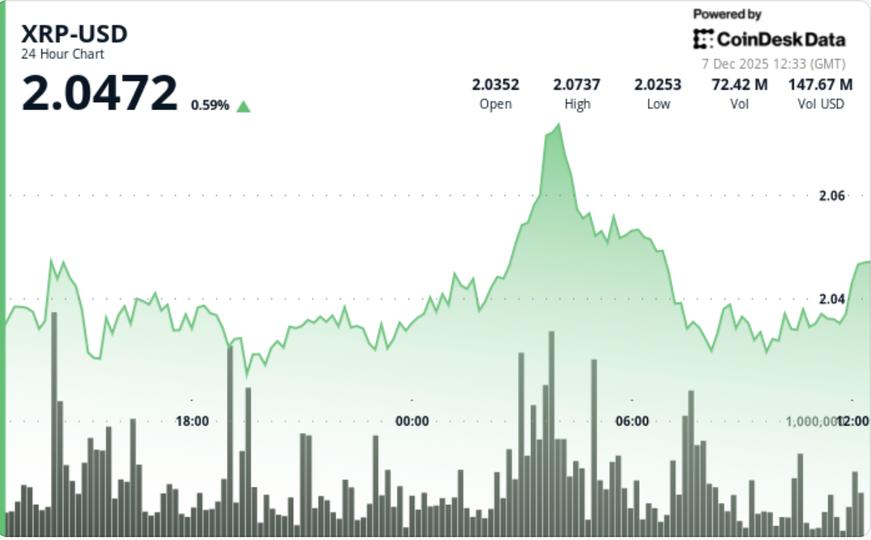

Technical indicators on multiple time frames point to structural weakness despite brief attempts at a break above the $2.05 resistance during overnight trading.

News background

- XRP continues to face pressure as its weekly performance deteriorates to -7.4%, adding to the multi-session downtrend dominating early December.

- Despite persistent price weakness, institutional demand remains strong across US XRP spot ETFs, which have attracted $906 million in net inflows since their launch, with no outflow days recorded.

- Meanwhile, social sentiment has collapsed to extreme fear readings matching October lows, with Santiment reporting the highest level of bearish commentary in more than five weeks.

- Historically, these extremes preceded short-term rebounds, including the Nov. 21 rally.

- On-chain data shows mixed positioning: 6-12 month holders significantly reduced exposure, falling from 26.18% to 21.65%, while ETF-driven long-term demand continues to build quietly in the background.

Technical analysis

- XRP’s attempt to break higher was initially successful, with the price surpassing $2.05 with a volume increase of 68% above average at 03:00. The breakout produced a strong rally to $2.07, but the movement was not continued. Decreasing volume on the pullback revealed fading momentum and sellers quickly regained control.

- A persistent descending channel has now formed on the 60-minute chart, featuring successive descending highs and increasing price compression. This structure reflects an orderly trend-driven decline rather than a panic sell-off.

- Each bounce has found distribution, particularly near $2.04-$2.05, an area that now functions as immediate resistance.

Momentum oscillators are trending lower on intraday time frames, while the weekly TD Sequential indicator is quietly showing a possible reversal signal. - This creates an environment of short-term weakness along with signs of long-term stabilization in the early stages.

Price Action Summary

- XRP traded within a range of $0.0563 (2.8%), moving between $2.02 and $2.07 before closing near $2.032.

- The breakout to $2.07 was fueled by a volume increase of 44.99 million (68% above the SMA), but the rally completely reversed as volume declined.

- The 60-minute structure shows XRP declining from $2,040 to a test of support at $2,029, with volume of 1.08 million during the low, clear evidence of institutional distribution rather than opportunistic buying.

- XRP is now consolidating around USD 2,030, where maintaining this pivot becomes critical to avoid deeper tests of the zone between USD 2,020 and USD 2,025.

What traders should know

- XRP’s near-term trajectory remains fragile as technical forces dominate otherwise supportive fundamentals such as ETF inflows and long-term accumulation.

- A recovery of $2.035 is required to restore intraday momentum, while a clean break above $2.05 would be needed to invalidate the descending channel.

- If the $2.030 level gives way, traders should anticipate a retest between $2.020 and $2.025, with psychological support at $2.00 as the final line before a broader decline opens.

- Sentiment is deeply negative, which has historically aligned with early reversal setups, but until a technical trigger emerges, the predominant trend remains to the downside.