Merchants prepare for continuous disadvantage as resistance limits at $ 3.04 and $ 2.93 floors arise after 169 m volume.

What to know

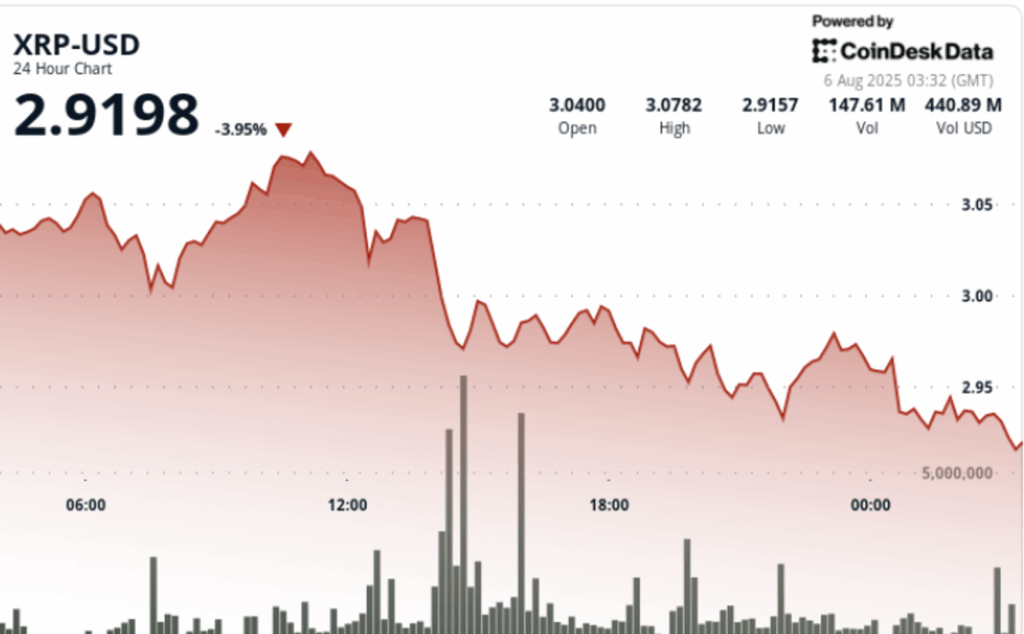

XRP fell 4.2% during the 24 -hour session that ended on August 6 at 02:00, withdrawing from $ 3.0 to $ 2.93 in a volume -based breakdown. The maximum of the $ 3.0 session was reached at 10:00 before an acute investment was established.

Final time price action confirmed the bearish control. XRP slipped 1% of $ 2.94 to $ 2.92 between 01:15 and 02:14, completing a high volatility session that saw a swing of $ 0.13, or an intradic range of 4.2%. An explosion of volume at the end of 02:11 of 1.6 million sealed the decline as the fresco intraayos token.

Summary of the price action

- XRP negotiated within a range of $ 0.13 between $ 3.08 and $ 2.93.

- The price collapsed 4.2% in 169.41 million total volume.

- The maximum decrease occurred between 14:00 and 15:00 with the highest time sales volume.

- The final time experienced 1% additional decline, led by a trade of 1.6 million at 02:11.

- Resistance tapas at $ 3.04; Support forms at $ 2.93.

- The consolidation range is now between $ 2.96 and $ 2.97.

Technical analysis

The price structure confirms the rejection of $ 3.04 with an immediate inconvenience to $ 2.93 in the volume higher than the average. Failure to comply with mobile averages in the short term and the lack of maintenance above $ 3.00 points to the continuation risk. Volume Spikes during keys sales admit the bearish bias.

Volatility remains high without clear investment signals. If $ 2.92 fails, the next support areas are about $ 2.87 and $ 2.80 depending on historical volume nodes.

What merchants are seeing

- Claim the psychological level of $ 3.00 and the defense of the $ 2.93 zone.

- If the bullish divergence arises in the indicators of intra -impulse.

- Impact on the broader market of macro risk feeling driven by geopolitical tensions and renewed commercial instability.