XRP extended losses in the last 24 hours, sliding under the $ 3.00 mark after strong resistance rejection. A combination of blockchain security concerns and delayed regulatory decisions promoted a great sale and profits in institutional desks.

News history

• A security audit classified the lowest XRP book among 15 blockchains, eroding investor confidence.

• SEC delayed decisions in multiple ETF XRP requests, including the presentation of Coinshares de Nasdaq, until October.

• The greatest regulatory ambiguity and security doubts fueled the portfolio settings in the main commercial companies.

Summary of the price action

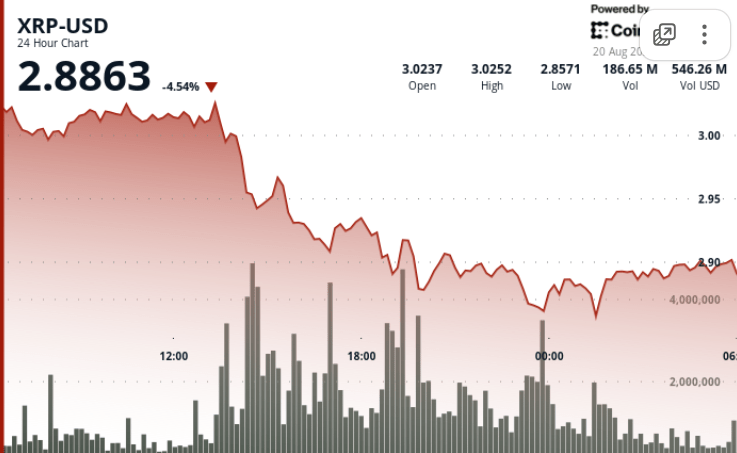

• XRP fell 4% of $ 3.02 to $ 2.90 between August 19 at 06:00 and August 20 at 05:00.

• The most pronounced fall came from 13: 00–15: 00 on August 19, when the price collapsed from $ 3.04 to $ 2.93.

• The volume increased to 137.18 million at 2:00 p.m., almost double the daily average of 71.23 million.

• Buyers defended $ 2.85– $ 2.88 several times during the night.

• The price stabilized about $ 2.89– $ 2.90 at the final time, showing a balance of less than $ 3.00.

Technical analysis

• Confirmed resistance to $ 3.04 with rejection driven by volume.

• Support area established at $ 2.85– $ 2.88 through repeated defenses.

• Consolidation at $ 2.89– $ 2.90 indicates the exhaustion of the immediate sales pressure.

• The volume increase highlights institutional repositioning.

What merchants are seeing

• If $ 3.00 endures again or remains a rejection barrier.

• Institutional flows at $ 2.85– $ 2.90 to determine if the level forms a base.

• Dryans in October as medium -term volatility controllers.

• Impact of security classifications on ETF approval perspectives.