XRP closed the Monday session under pressure, investing an earlier rally and ending near the threshold of $ 3.00. A strong sale at the final negotiation time saw the fall of the asset 1% in the increasing volume, which suggests the institutional distribution and the liquidations of STOP -loss by promoting the action of the price.

The technical analysis shows mixed signals

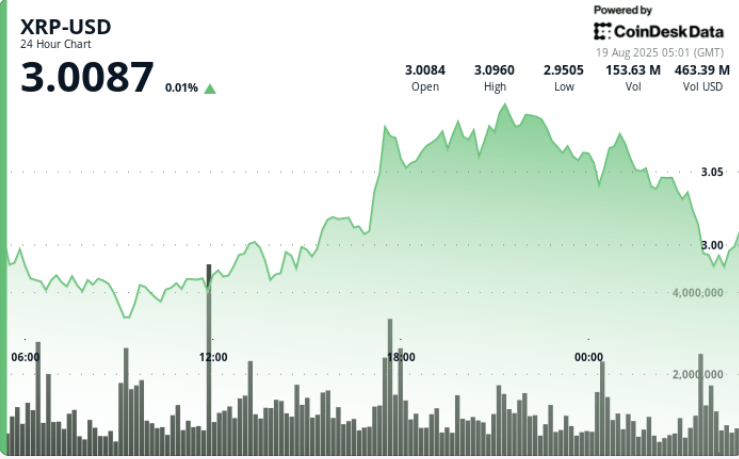

XRP negotiated within a range of $ 0.11 between $ 2.94 and $ 3.10 in the 24 -hour session of August 18 05:00 to August 19 04:00, which represents almost 4% of intra -intrade volatility. An upward breakdown during the negotiation time of 5:00 on August 18 exceeded the prices of $ 2.97 to $ 3.10, backed by a heavy volume of 131 million, double the average of 24 hours of 66.8 million. This established a short -term support about $ 3.00.

However, the impulse faded quickly. The Token rejected $ 3.09 several times, sliding around $ 2.99. An aggressive setback took place during the 03:00 hours on August 19, when XRP fell from $ 3.04 to $ 2.99.

Key market movements

• XRP decreased by 1% in the last 60 minutes, sliding from $ 3.03 to $ 2.99 as the volumes increased to 5.26 million, five times the average per hour

• The distribution pressure accelerated around the psychological threshold of $ 3.00, which triggers loss arrest liquidations during interval 03: 43–03: 46

• An upward increase in the session (August 18, 17:00) lifted XRP from $ 2.97 to $ 3.10 in a volume of 131 million, an activity well above the average

Market Dynamics promotes crisp

The breakdown of the late session confirmed the institutional sale about $ 3.00, erasing the impulse of the previous rupture. While $ 2.99 provided intra -stabilization, the rejection backed by volume to $ 3.09 highlights the growing resistance pressure.

XRP is now at a crossroads: keeping above $ 2.99 could allow the bulls to test the cluster of $ 3.08– $ 3.09, while the fault runs the risk of a deeper correction towards the demand zone of $ 2.96.

Summary of technical indicators

• Range: $ 0.11 (3.8%) between $ 3.10 peak and $ 2.94 channels

• Resistance: $ 3.09, repeatedly rejected through night sessions

• Support: Psychological level of $ 3.00, tested under high volume distribution

• Risk: Displosed towards the demand zone of $ 2.96 if $ 2.99 failure

• Signal: structure of the intact bullish triangle, but the impulse that fades under profits