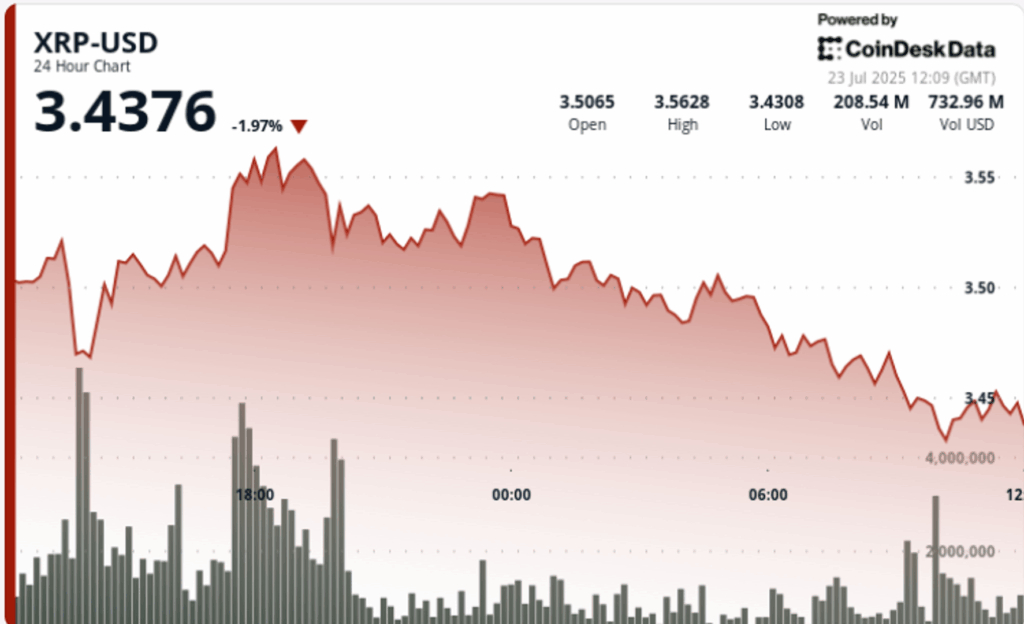

XRP quoted in a wide range of $ 0.11 between $ 3.46 and $ 3.57 during the 24 -hour period ending on July 23 at 08:00 GMT. The asset registered a 3% swing since Bulls led the price to a $ 3.57 session at 106.4 million volume, before the profits activated a reversion at $ 3.46.

The late decrease broke the key support at $ 3.50, which had been tested again during the night.

The volume increased as institutional flows reacted to a confluence of catalysts: to advance in the cryptographic legislation of the United States, new approvals of ETF and the update of long -awaited technical patterns. Analysts still point at a price of $ 6– $ 15 are directed in the long term, but warn about the risk of short -term consolidation.

News history

• XRP broke over $ 3.65 last week, completing a six -year symmetrical triangle.

• Proshares launched the first ETF of futures XRP, marking a milestone in regulated institutional access.

• The United States Congress advanced acts of genius and clarity, promoting the clarity of cryptographic regulation, feeding funds to digital assets of great capitalization.

Summary of the price action

The most aggressive movement occurred at 5:00 p.m. GMT on July 22, when XRP increased from $ 3.52 to $ 3.56 in less than an hour by 106.4 million volume, more than 50% above the daily average of 70.1 million. The resistance was formed in the area of $ 3.56– $ 3.57, limiting up and activating a constant withdrawal through the session during the night.

The final time (07: 10–08: 09 GMT) saw a breakdown of $ 3.47 to $ 3.46, since the volume increased to 2.5 million between 07:37 and 07:49. That movement broke the support band of $ 3.49– $ 3.51 previously, confirming a change in short -term trend as selling overwhelmed buyers.

Technical analysis

• 24 -hour negotiation range: $ 3.46– $ 3.57 (3.18%)

• Breakout Alcista at 5:00 p.m. 22: $ 3.52 → $ 3.56 in volume of 106.4m

• Support area: $ 3.49– $ 3.51 tested several times during the night, failed at session

• Resistance Zone: $ 3.56– $ 3.57 Limited Rally, now defining the next break point

• Issong confirmation: $ 3.47 → $ 3.46 in a volume peak of 2.5m

• Neutral RSI; MacD turning lower: signals probably consolidation before the following directional movement

What merchants are seeing

Institutional participation remains high amid ETF tickets and improving regulatory optics. Despite the short -term rejection of $ 3.57, analysts continue to mark bullish configurations aimed at $ 6.00 and even $ 15.00 on deadlines of several months. The level of $ 3.50 now acts as a psychological pivot so that the bulls are defended in the next sessions.