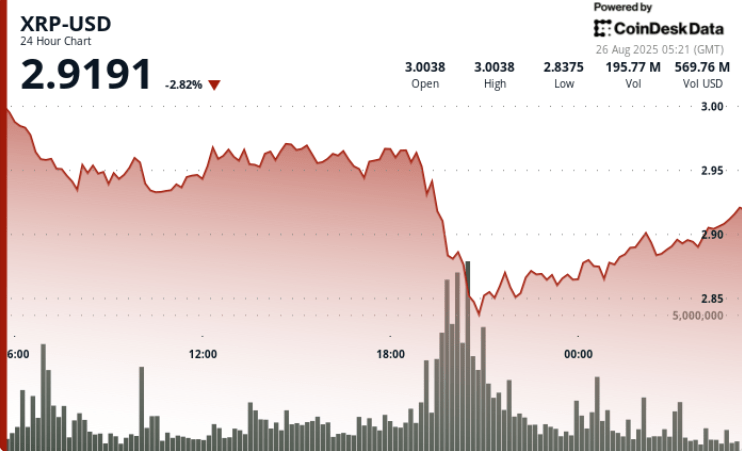

XRP faced steep swings in the negotiation window from August 25 to 26, sliding from $ 3.01 to $ 2.91 for a loss of 3.2%. An institutional liquidation explosion during the hours of 19: 00–20: 00 GMT led the most acute fall, with volumes tripling daily averages. The recovery attempts at the end of the session brought the Token above $ 2.90, but the market is still divided into itself the rising impulse can sustain.

News history

- XRP has negotiated with high volatility until August, with repeated failures above $ 3.00.

- Whale wallets and institutional flows have promoted short -term swings, adding pressure on retail positioning.

- The broader encryption reference points published more stable profits, leaving XRP to their peers in the middle of a regulatory cantilever in the United States

- Crypto Exchange Gemini, founded by Cameron and Tyler Winklevos, told Coindesk that he has associated with Ripple to launch an XRP edition of his credit card in association with Webbank.

- The card offers up to 4% refund in XRP in fuel, EV load and shared trips, 3% in dinners, 2% in groceries and 1% in other purchases. Gemini said he is also working with selected merchants to offer up to 10% return in eligible spending.

Summary of the price action

- XRP decreased 3.24% of $ 3.01 to $ 2.91 in 24 hours, within a range of $ 0.28 (9% volatility).

- The maximum sale occurred between 19: 00–20: 00 GMT since XRP fell from $ 2.96 to $ 2.84 in 217.58 million volume, well above the daily average of 72.45 million.

- The Token recovered from 0.69% in the final negotiation time, rising from $ 2.89 to $ 2.91 with institutional flows with an average of 641,000 per minute.

Technical analysis

- Confirmed resistance at $ 2.96, aligning with the rejection of the Bollinger Superior Band.

- Support built at $ 2.84– $ 2.86, consisting of the average mobile zone of 20 days.

- The intradic floor of $ 2.89 shows the accumulation, with RSI recovering from survey levels about 42 in the mid -50, which suggests a stabilizing impulse.

- The MACD histogram narrows towards a bullish crossing, pointing out the potential change in the short -term trend.

- Sustained operations are needed above $ 2.90 to open route to $ 3.20 – $ 3.30; Break below $ 2.84 sliding risks towards the $ 2.80 support.

What merchants are seeing

- The bulls point $ 3.70 if the moment extends and the volumes are normalized.

- The bears indicate $ 2.80 as the level of breakdown that could accelerate losses.

- Institutional absorption remains key, whether big players continue to support offers around $ 2.89– $ 2.90 will dictate the next section.