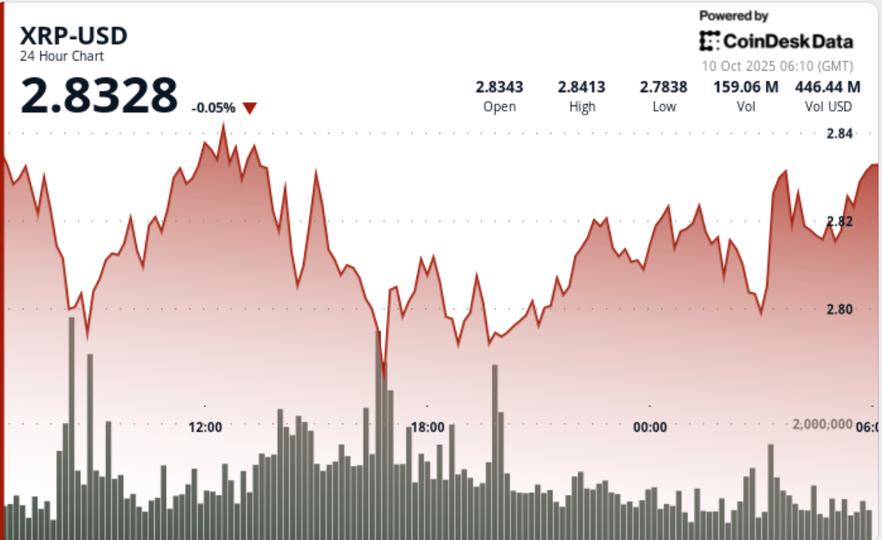

XRP split into a narrow band between $2.78 and $2.85, masking heavy institutional selling and rising leverage risks. Currency reserves rose to nine-month highs at 440 million tokens distributed over 30 days, while futures open interest rose nearly $9 billion.

The bulls continue to defend the $2.78 floor, but distribution patterns limit the bullish momentum.

News background

XRP traded flat to bearish in the 24 hours through October 10, opening near $2.83 and closing at $2.82. The token briefly recovered to $2.85 before rejection, with volumes exceeding 123 million as of 08:00 (double the daily average), confirming institutional activity at key levels. The session came as traders positioned themselves ahead of macroeconomic catalysts, as Fed policy and regulatory clarity continued to shape sentiment.

Price Action Summary

- XRP ranged between $2.79 and $2.85, a 2% corridor.

- Resistance held firm at $2.85, with rejection at 12:00.

- Support persisted at $2.78, defended repeatedly with heavy volume.

- At the end of the session there was a drop from $2.83 to $2.82, with 1.6 million impressions confirming continued distribution.

- The final bars showed waning volume, hinting at selling exhaustion near $2.82.

Technical analysis

The $2.85 zone has consolidated as a bid after multiple rejections, while $2.78 remains the key support pivot. FX inflows and distribution from large holders reinforce near-term downside risk, particularly as leverage increases with OI futures approaching $9 billion.

Still, repeated defenses of $2.78 indicate institutional accumulation at the base. A break above $2.85 could reopen the price between $2.90 and $3.00, while a drop above $2.78 risks accelerating towards $2.72.

What are traders watching?

- If $2.78 continues to remain as a structural floor.

- If the leverage positioning unravels, it will add volatility to the attempt to retest $3.00.

- Current whale distribution versus signs of submergence accumulation.

- ETF and Fed catalysts as drivers of next breakout of $2.78 to $2.85 range.