What to know

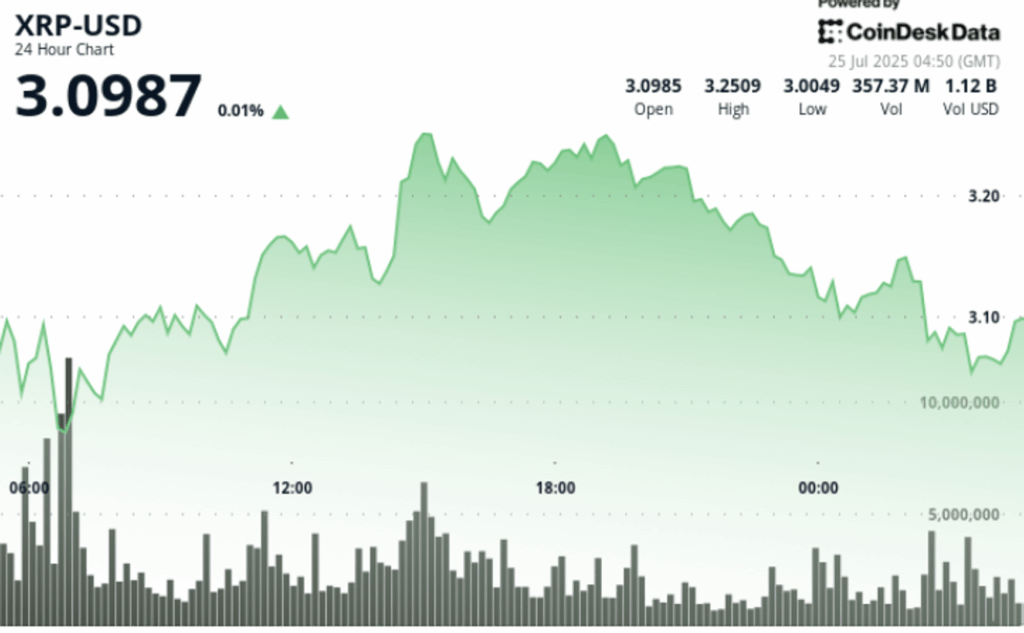

XRP registered acute losses during the session from July 24 to 24, falling 8% as the Token quoted in a range of $ 0.30 from $ 2.96 to $ 3.26.

An early session rally failed after the profits intensified near the level of resistance, while a sudden liquidation wave eliminated more than $ 100 million in long positions.

Despite the key sale, the key support of $ 3.06– $ 3.10 is maintained through repeated tests, with a late session price action that shows signs of potential stabilization.

Nature’s Miracle and Brazil’s Vert arrived at the headlines with new XRP -based strategies, but institutional vendors dominated the tape amid fears that ETF approvals can face delays.

News history

• XRP quoted at a range of 7.85% between $ 2.96 and $ 3.26 in 24 hours from July 24 to 05:00.

• Caramel data showed more than $ 18 billion in total cryptographic settlements during the session.

• XRP Long settlements exceeded $ 105 million, which contributed to rapid decreases.

• Nature’s Miracle announced a $ 20 million XRP Treasury plan.

• Brazil headquarters with headquarters deployed a blockchain solution of $ 130 million built in the Book Mayor XRP.

Summary of the price action

The session opened to $ 3.13 and saw a strong fall at $ 2.96, followed by a bouncing to a maximum of $ 3.26 at 15:00 in 175.94 million volume, more than double the average. However, resistance to $ 3.24– $ 3.26 limited profits. The price collapsed again at the end of the session, falling to $ 3.05 during window 03: 00–04: 00 in an increase in volume of 6.2 million, probably due to forced sales or settlement flows. XRP recovered modestly to close at $ 3.08.

Technical analysis

• Negotiation range of $ 0.30 between $ 2.96 minimums and $ 3.26 high.

• Strong resistance was confirmed at $ 3.24– $ 3.26 after the memory of rejection 15:00 Rally.

• Critical support at $ 3.06– $ 3.10 repeatedly tested with volume backed bounces.

• The final time shows a breakdown at $ 3.05 before recovering $ 3.08, a possible bullish investment signal.

• Liquidation driven volatility suggests greater risk, but firm supply areas offer a short -term structure.

What merchants are seeing

• If XRP can keep the area of $ 3.06– $ 3.10 in the next session.

• Impact of new developments related to the ETF of the regulators of the United States.

• Signs of institutional re -entry or renewed retail participation above $ 3.15.

• Broader stability of the cryptography market after multimillion -dollar liquidations.