XRP increased 3% when the president of the Federal Reserve, Jerome Powell, firmly put a September rate cut on the table on Friday, which caused Bitcoin (BTC) and the important tokens move higher.

470 million timben timbentes led volume peaks and strong resistance to $ 2.92, while delays in the ETF and weak security classifications composed of the bearish pressure.

News history

• Institutional settlements dominated trade since 470 million XRP were discharged through the main exchanges during the window from August 21 to 22, which caused a sale of an accelerate sale.

• The chain settlement volumes increased from 500% to 844 million tokens on August 18, one of the largest peaks of this year, indicating the growth of adoption despite the weakness of the market.

• SEC postponed decisions about ETF XRP requests, including the presentation of Coinshares de Nasdaq, now expected in October. The delay adds to regulatory uncertainty.

• A security evaluation placed XRPL in the lowest classification between 15 blockchains, which raises concerns about the robustness of the network and adds to the bearish feeling.

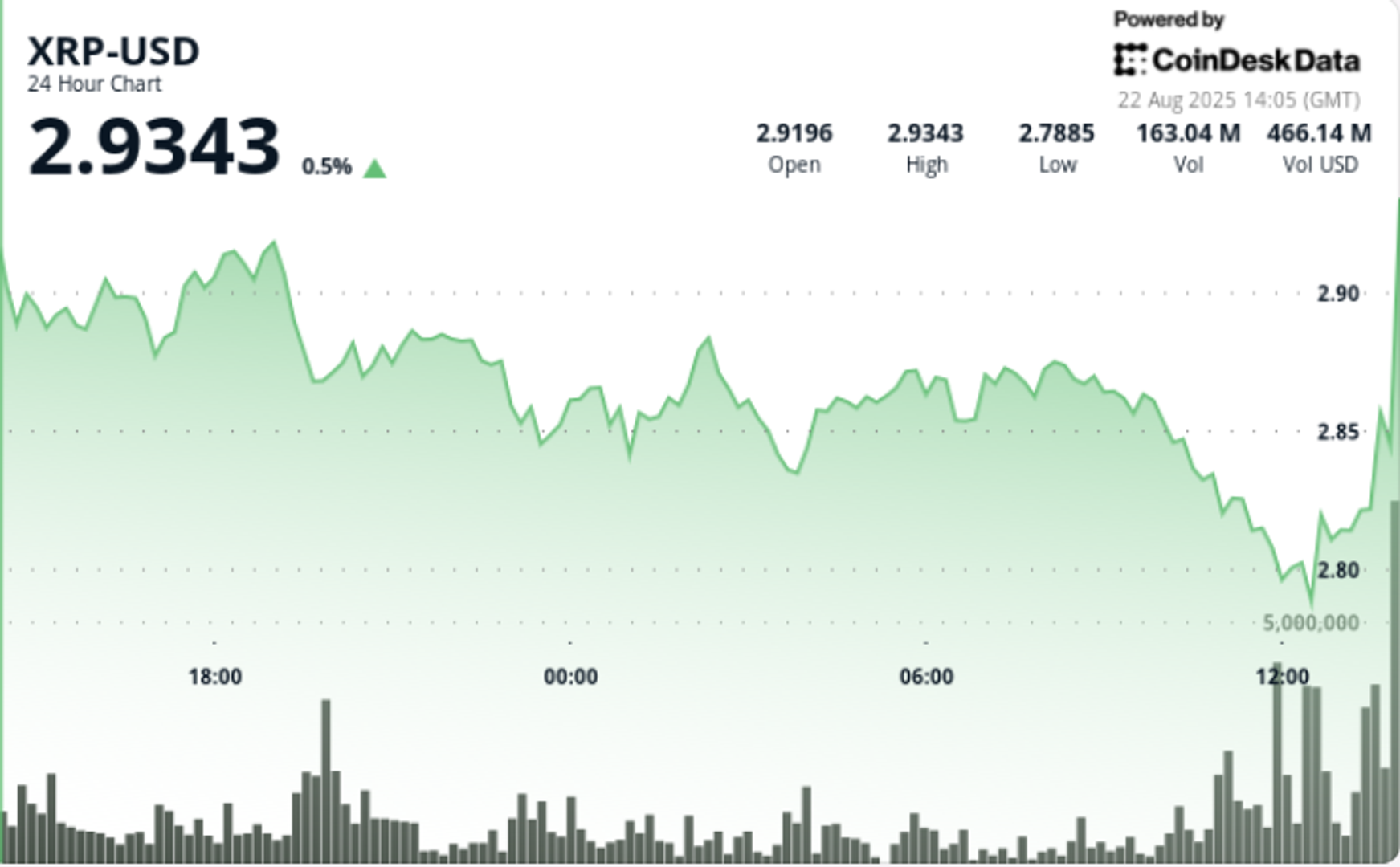

Summary of the price action

• XRP decreased 3.1% in the 24 -hour session from August 21 from 1:00 p.m. to August 22, 12:00, falling from $ 2.89 to $ 2.80.

• The Token varied $ 0.12, a 4.25%volatility band, between a peak of $ 2.92 and $ 2.80.

• The most acute movement occurred at 7:00 p.m. on August 21, when XRP was rejected at $ 2.92 in a volume of 69.1 million, confirming greater resistance.

• Final time trade (August 22 11: 24–12: 23) saw a drop of XRP 2.5% of $ 2.82 to $ 2.80 in a 7.2M rising volume, confirming the bearish continuation.

• The support emerged about $ 2.80– $ 2.85, but the accumulation interest weakened with each reestima.

Technical indicators

• hardening resistance to $ 2.92 in volume rejection of 69.1m.

• Support identified in an area of $ 2.80– $ 2.85, although weakening in repeated tests.

• Volume increased to 96m at 11:00 August 22, confirming the bearish monitoring.

• The negotiation range of $ 0.12 (4.25%) highlights the concentration of volatility.

• Final time sealed 2.5% with the bassist validate of the volume of 7.2m.

What merchants are seeing

• If $ 2.80 can be maintained as a support; A break risks the acceleration towards $ 2.75.

• ETF -related holders, with October October decisions for broader institutional flows.

• Whale accumulation patterns: the growth of adoption in the chain, but prices do not reflect the foundations.

• $ 2.92– $ 3.00 Resistance zone as a trigger for bullish investment.