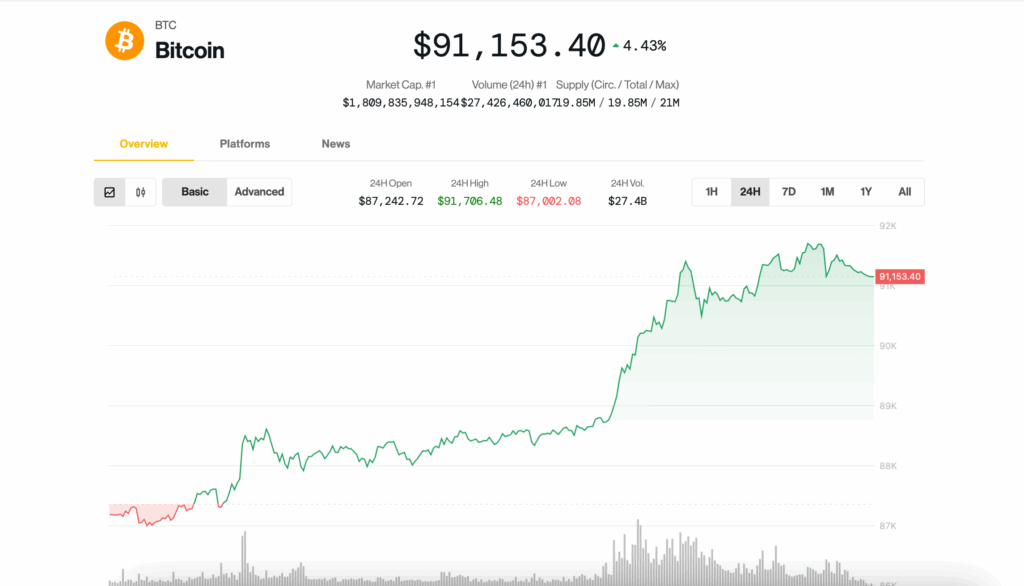

Bitcoin (BTC) increased more than $ 91,000 on Tuesday, climbing almost 5% amid renewed investors and new hopes of a thaw in the commercial tensions of the United States and China, but the winds against persist that could limit more upward, the analysis firm Cryptoquant warned.

The largest cryptography for market capitalization reached $ 91,700 on the afternoon of the USA, its strongest price since the beginning of March. Altcoins followed BTC higher, with Ethereum’s Ether (ETH) increasing 8% in the last 24 hours above $ 1,700, and Dogecoin (Doge) and the native SUI (SUI) tab won 8.6% and 11.7%, respectively. The large market crypto reference index COINDESK 20 advanced 5.2%.

The markets were promoted by the comments of the United States Secretary of the Treasury, Scott Besent, who, according to reports, told investors in a JPMorgan closed door event that the tariff confrontation with China was unsustainable. Besent said that decalcalance would come “in the very close future”, characterizing current conditions as a “commercial embargo.” However, he warned that a more complete agreement between the two nations could take years.

The actions recovered from the decline of yesterday, with the S&P 500 and the nasdaq heavy technological finishing the session 2.5% and 2.7% higher, respectively. Meanwhile, gold was abruptly invested with its record price of $ 3,500 during the day and fell by 1%.

“As the capital turns to safe assets and inflation coverage, BTC and Gold are demonstrating key beneficiaries of the exodus of the USD risk,” said analysts of the QCP Capital Coverage Fund in a Telegram transmission.

They highlighted the rejuvenating entries to detect ETF BTC that quote in the United States and the return of the so -called coinbase price premium, which suggests the demand of US institutional investors. BTC ETF reserved more than $ 381 million net tickets on Monday, which adds to $ 107 million on Thursday, according to Farside investors data.

But not all signs point to a sustained breakup.

Despite the price jump, the data in the chain in the chain point to the fragility under the surface, cryptocancy analysts said in a Tuesday report. Bitcoin’s apparent demand has decreased by 146,000 BTC in the last 30 days, an improvement of the strong fall in March, but still negative. Cryptoquant’s demand impulse, which tracks the interest of new investors, has further deteriorated at its most bearish level since October 2024, the report said.

Market liquidity remains soft, and the report uses the growth of USDT market capitalization as a proxy of cryptographic liquidity. The USDT grew $ 2.9 billion in the last two months, below its average of 30 days. Historically, BTC demonstrations coincided with a USDT growth above $ 5 billion and a higher trend, a threshold not yet fulfilled.

In addition to the precaution, Bitcoin now faces a key resistance zone between $ 91,000 and $ 92,000 in around the “price made in chain in the merchant chain”, a level that has often served as resistance in low conditions. The Cryptoquant chain bull score classified the current market conditions as bassists, which suggests a pause or setback could follow if the feeling weakens.