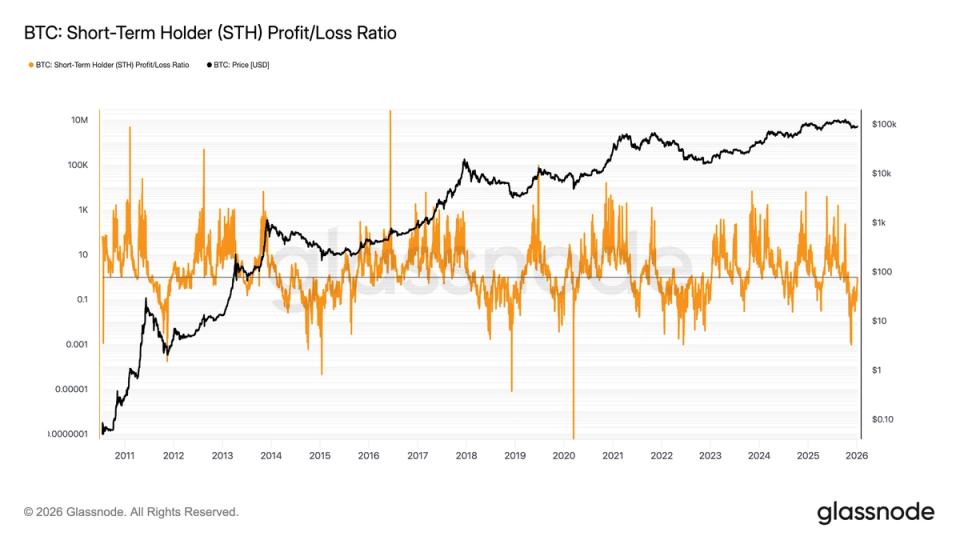

like bitcoin fell in late November to almost $80,000, the ratio between the bid of short-term holders in profits and the bid of short-term holders in losses fell to levels that have historically coincided with important or local lows of bear markets.

On November 24, the ratio decreased to 0.013. Every previous case where the ratio reached this level has marked a local bottom or definitive bear market bottom, including in 2011, 2015, 2018 and 2022, according to Glassnode data.

Glassnode defines short-term holders as investors who have held bitcoins for less than 155 days. At the November low, the seven-day moving average of short-term holders’ profit bid fell to approximately 30,000 BTC. By contrast, short-term holders’ supply loss rose to 2.45 million BTC, the highest level since the FTX crash in November 2022, when bitcoin bottomed near $15,000.

Since the beginning of 2026, bitcoin has risen to around $94,000, a jump of more than 7%. During this period, the supply of short-term holders at a loss has decreased to 1.9 million BTC, while the supply of short-term holders at a profit has recovered sharply to 850,000 BTC, a ratio of approximately 0.45.

Historically, when the ratio approaches 1, it tends to exceed it and continue to expand beyond that value. Bitcoin price tends to enter a sustained bullish phase at the same time. With the ratio currently below 0.5%, the metric suggests there is still room for further significant expansion before breaking even.

As for maximums, they tend not to occur until the ratio increases towards 100.