The dollar index (DXY), which measures the fortress of the US dollar against a basket of other currencies, has fallen below the 100 mark for the first time since April 2022.

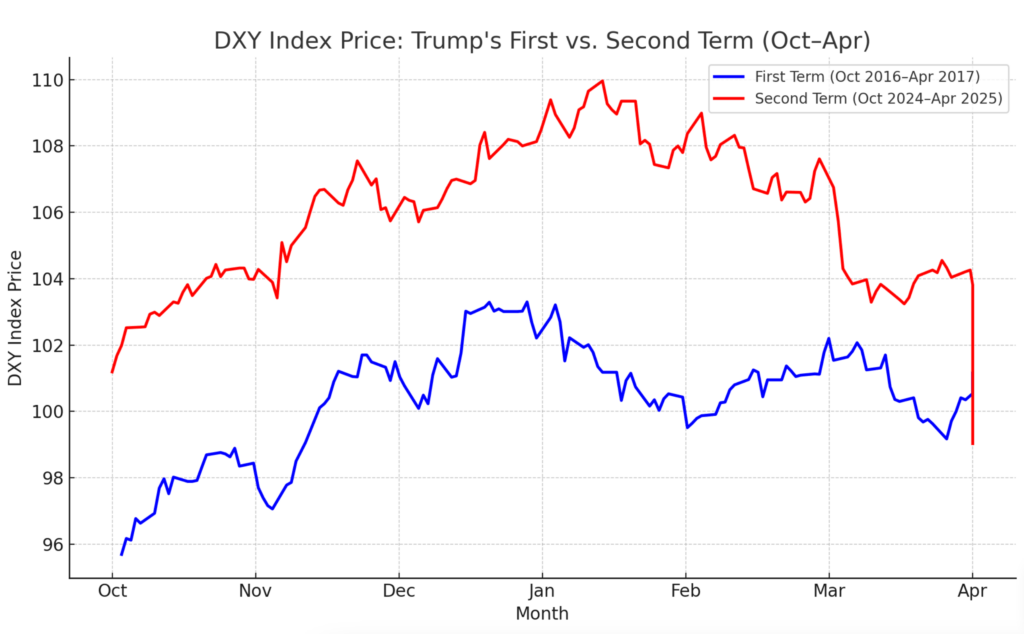

In January, Coendesk’s investigation said the DXY index was reflecting the pattern seen during President Trump’s first mandate, and now it seems to have done exactly that. The index has fallen more than 10% since its recent maximum of 110 and is now at its lowest level in three years.

The feeling of investors continues to move away from the US assets, storing a more downward pressure on the dollar, as commercial tensions between the United States and China intensify.

Just before the moment of publication, China announced an increase in tariffs on US goods, which increases the total tax to 125% of 84%, indicating a firm position in the ongoing commercial dispute.

Meanwhile, Bitcoin (BTC), which has recently behaved as a low asset compared to shares, remains resistant and continues to operate above $ 81,000.