Token native to Solana, Sol

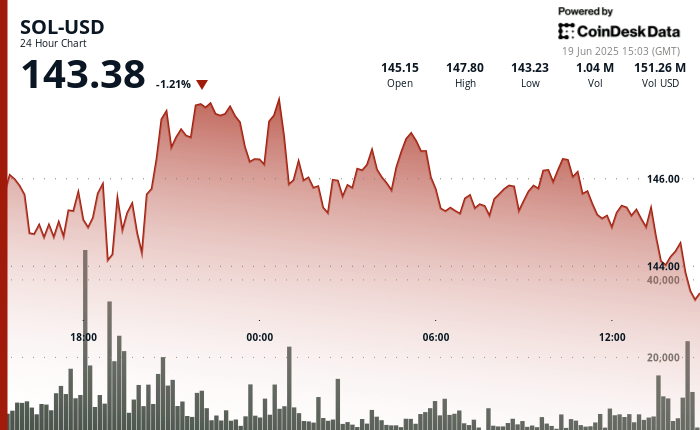

It fell to $ 143.38 on Tuesday, a lower 1.21%, closing near the minimum of the day after not keeping above $ 147, according to the technical analysis model of Coindesk Research.

The weakness occurred even when the ecosystem attracted a new institutional support: the Canadian strategies of Blockchain Sol investor that appeared before the United States Stock Exchange and Securities Commission on June 18 to pursue a list of Nasdaq under the Ticker Stke.

While the presentation itself is not an immediate mudajita of the market, it highlights a growing institutional commitment to the long -term perspective of Solana. Sol Strategies revealed earlier this month that he owns more than 420,000 Sol, with a value of more than $ 61 million, and has turned the Sun into the centerpiece of his treasure strategy. The firm is also looking for regulatory approval in Canada to raise up to $ 1 billion, in addition to a convertible note of $ 500 million above in April used to acquire and bet Sun.

Despite these upward signals, Sol continues to be defensive. Price Action has been limited to a horizontal band for much of last week, with the most recent breakdown of rupture greater than $ 147.80 by not generating follow -up. The bears regained control during the last hours of trade, pushing sun below the psychological support of $ 144. With the prices tendency below the main mobile averages and the volume that narrows in the middle of the session, the feeling remains fragile even while the long -term backing intensifies.

TECHNICAL ANALYSIS

- Sol quoted in a 24 -hour range of $ 143.23 to $ 147.80, a 2.83%swing.

- The resistance remained at $ 147.80 after a failed break during the UTC candle of 22:00 on June 18.

- The price constantly decreased to $ 143.38, closing close to the bass after the weak recovery attempts.

- The vendors were active between 13: 46–14: 00 UTC, with a drop of $ 144.62 to $ 143.38 in a strong downward impulse.

- The $ 144– $ 145 area is still critical; Not recovering it can open a path to deeper support near $ 140.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.