Solana (Sol)

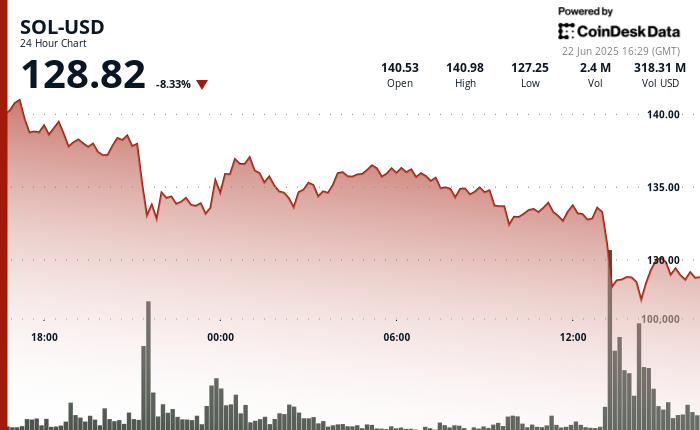

It is quoted at $ 128.82, 8.33% less in the last 24 hours, after a strong intradic correction linked to the increase in geopolitical tensions. The Token fell from $ 140.39 to $ 127.25, with the decrease per stronger hour that occurs at 13:00, when the enriched sales pressure and negotiation volume exceeded 4 million, according to the technical analysis model of Coindesk Research.

The market reaction followed the confirmed reports of US military attacks aimed at Iranian nuclear sites, which caused a generalized aversion of risks in cryptographic markets.

Some merchants are now worried that a hormuk Strait closure, even if it is temporary, could send oil prices. That would probably enliven inflation, reduce the chances of short -term feeding rate cuts and prolong the risk environment that harms cryptography markets. A direct attack on the river route could intensify the sale of Altcoins, as Bitcoin’s domain is historically elevated during periods of geopolitical agitation.

The sun decrease also marked a break below the key technical levels, including the simple 200 -day mobile average about $ 149.54. Throughout the session, Sol printed lower maximums and fought to keep the rebounds, pointing out weakening the structure of the market. With a high volume in red candles and technical indicators that intermit down, merchants are now observing the $ 120- $ 125 area as a potential support area.

TECHNICAL ANALYSIS

- Sol fell 8.1% of $ 140.39 to $ 129.02 during the analysis period, forming a decrease of $ 11.37.

- The broader price range of the session was extended from $ 141.14 to $ 126.85, an intra -dialy swing of 10.2%.

- The largest hour’s fall occurred at 1:00 p.m., and the price fell from $ 133.58 to $ 128.82 in a volume of 4.03m.

- A descending channel was developed in the session, with lower and lowest high ups and dotter confirmation of the bearish structure.

- The key resistance was formed to $ 133.80, which limited multiple rebound attempts.

- The initial support arose at $ 127.43, while a new intradic floor formed at $ 128.90.

- From 15:25 to 15:27, a volume peak exceeded the price below $ 129.30 during a continuation advantage.

- The late session movement showed that Sol is quoted between $ 130.42 and $ 128.85 under consistent sales pressure.

- Several recovery attempts about $ 130.05 failed as the volume increased in each rejection.

- The significant concentration of supply appeared about $ 130.20, reinforcing the short -term bassist impulse.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.